The dark money group No Labels, which is preparing to run a third-party presidential ticket, says it has “created a growing national movement of commonsense Americans.” While the group has been making its pitch, one of its PACs has been earmarking donations for wealthy executives and billionaire investors.

The No Labels Problem Solvers PAC has been used this year to route hundreds of thousands of dollars in campaign donations to members of Congress, according to Federal Election Commission data. Its top recipients include House Problem Solvers Co-Chair Rep. Brian Fitzpatrick (R-Pa.), with almost $246,000; Rep. Vicente Gonzalez (D-Texas), with almost $132,000; and Rep. Tony Gonzales (R-Texas), with $30,000.

The PAC operates as a conduit that allows individual donors to earmark funds to political campaigns. The donations are given by the PAC, but because they are earmarked from individual donors the PAC does not have to abide by contribution limits and can funnel unlimited amounts of money to campaigns.

Around half of the at least 115 individual donors who gave through the No Labels Problem Solvers PAC this year reported their occupation as CEO, investor, executive, or similar titles, according to Sludge’s review of FEC data. Dozens more gave their occupation as retired.

Numerous private equity executives gave through the No Labels PAC as the group is pursuing its multistate ballot access effort. Chris Gaffney, managing director of Great Hill Partners, went through No Labels to contribute the per-cycle maximum of $6,600 to each of Fitzpatrick and Gonzalez, as did Roger Evans of Greylock Partners. John Connaughton, co-managing partner of Bain Capital, gave the maximum donation to Fitzpatrick via the PAC.

Other executives who have earmarked donations through No Labels this year include the following: Robert Stavis, partner at venture capital and investment firm Bessemer Venture Partners; Ron Shaich, CEO and managing partner of investment firm Act III Holdings; and Matthew Kaplan, chair of the Almanac real estate business at investment firm Neuberger Berman.

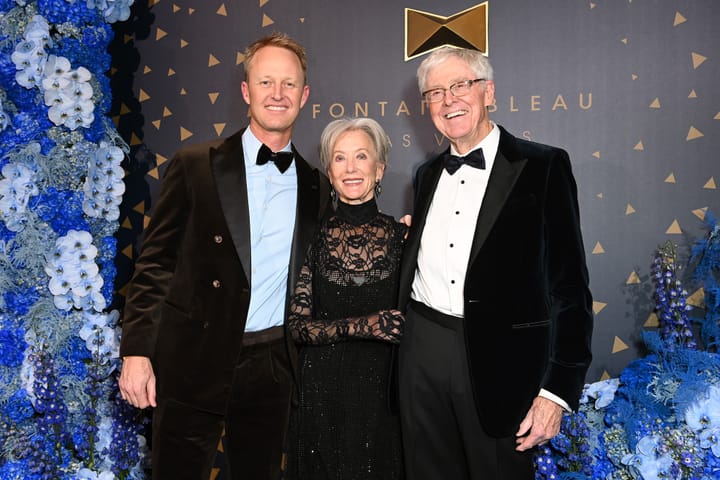

Billionaire investor Howard Marks of Oaktree Capital, reportedly a fundraiser host for No Labels, with his spouse Nancy gave $5,800 to Gonzales through the PAC in early April. Rare among No Labels’ largely-secretive donors, Marks has written a strategy memo about the role that the House Problem Solvers played in 2021 in forcing a vote first on the bipartisan infrastructure framework, supported by many business lobbying groups. The moderates’ efforts delayed votes on the larger social spending and environmental programs included in the Build Back Better Act, which giant business groups like the U.S. Chamber of Commerce battled with what the Washington Post called a “massive lobbying blitz.”