A new super PAC has been formed to support the planned third-party presidential ticket of the bipartisan political group No Labels. The group’s treasurer is the president and COO of a hedge fund that recently laid off 150 employees, and its political adviser is a Republican strategist who formerly worked for a firm that provided large companies with union avoidance services.

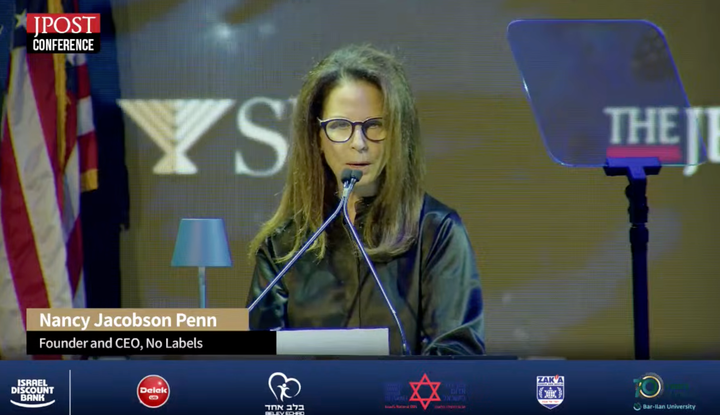

The super PAC, New Leaders 2024, said it had $2 million in commitments to back a bipartisan ticket from No Labels, according to the New York Times, and that it expects to raise up to $300 million. “New Leaders 2024 is being formed to support the election of a No Labels Unity Ticket, should one be named in the coming weeks,” the group said in a statement.

No Labels’ largest vehicle is a “dark money” nonprofit group that does not disclose its donors. A political organization it formed in 2022 for its presidential plans has been overwhelmingly funded by corporate executives. In 2023, billionaire investors like hedge fund co-founder Howard Marks and private equity executives from firms like Bain Capital used a No Labels PAC to funnel contributions to members of Congress.

The super PAC’s incorporation paperwork was filed with the Federal Election Commission by Andrew Fishman, who was identified by the group as a Democrat who has a business background. Fishman is the president and COO of investment company Schonfeld Strategic Advisors, founded in 1988, which incorporates hedge fund strategies in its business. Fishman is serving as New Leaders 2024’s treasurer.

Fishman began working with Schonfeld in 2004, according to his LinkedIn profile. In November, the hedge fund laid off 15% of its staff, mostly in non-investment roles like the information technology teams, after talks of a potential partnership were scuttled.

The firm Schonfeld is a member of the top trade association for hedge funds, the Managed Funds Association (MFA), which in 2022 lobbied against efforts by Democrats in Congress to narrow the “carried interest” tax rules used by many investment managers to reduce their tax rates. The trade group’s CEO Bryan Corbett warned that changing the tax treatment “would punish entrepreneurs in investment partnerships,” and the legislative proposal was dropped by Senate Democrats after demands by Arizona Sen. Kyrsten Sinema, who was then a Democrat and re-registered as an Independent.