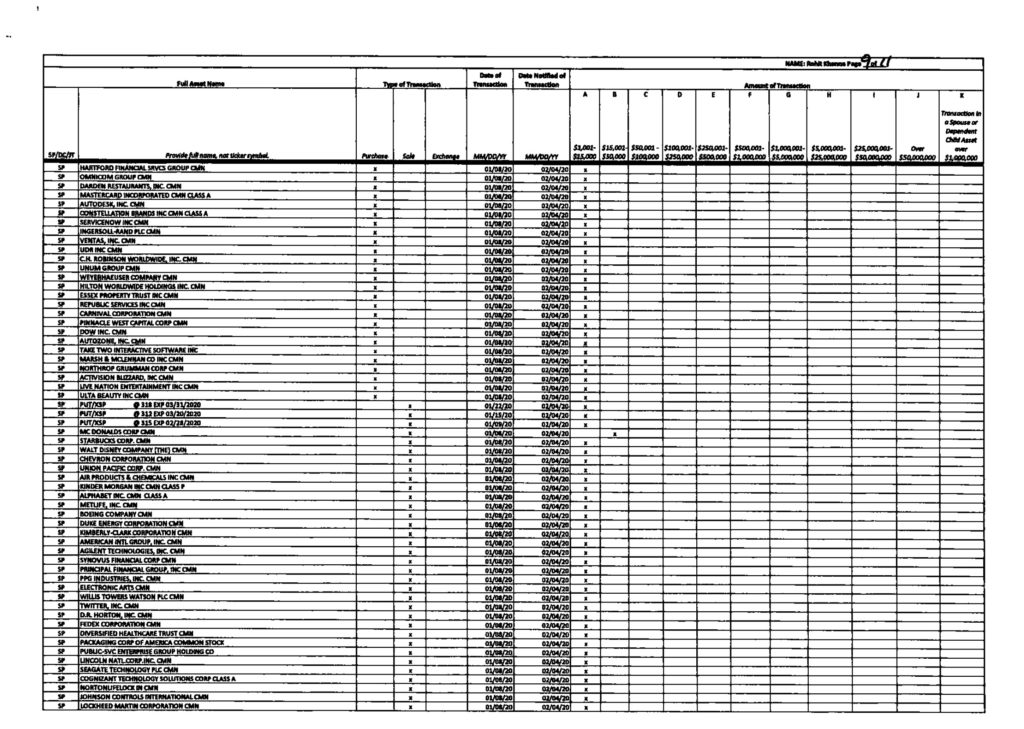

After Sen. Richard Burr (R-N.C.) was exposed for selling more than a million dollars worth of stocks ahead of the February market crash—a period when he was receiving daily briefings on the emerging coronavirus threat—people who wanted to check what other members of Congress had traded stocks faced a daunting task. Senators and representatives have to disclose their financial transactions, but the information is not made available to the public as a database, so watchdogs and journalists had to sift through hundreds of separate reports to look into all 538 federal legislators.

It was not supposed to be this difficult to monitor Congress’ stock trades. In 2012, when Congress passed the STOCK Act that required members to begin disclosing their trades, the bill stated that the House Clerk’s office and the Secretary of the Senate had to build systems to allow the public to “search, sort, and download data contained in the reports” within 18 months.

But that never happened. Shortly after the STOCK Act became law, Congress passed and President Obama signed into law a follow-up measure that repealed the database requirement.

“I intended having an online database that I could go onto and say show me every member of Congress who traded stock in the last 60 days,” explained Public Citizen government ethics expert Craig Holman, who worked on the STOCK Act and said he wrote the section on the online database. “But they didn’t make it that way. It’s just sort of like PDFs are posted on there.”

After the Burr scandal, Holman brought his concerns about how difficult it is to access the data to Sen. Kirsten Gillibrand (D-N.Y.), who had already been thinking about a separate but related financial transparency measure—requiring federal officials and members of Congress to disclose information about government grants or loans they receive. The two transparency issues were put together in one bill, and yesterday Gillibrand introduced a bill she is calling STOCK Act 2.0. A version was also introduced in the House, sponsored by Rep. Katie Porter (D-Calif.).

STOCK Act 2.0 states that Congress’ financial transaction records should be searchable and sortable by the criteria that members are required to report. The bill language is intended to describe a system that would allow the public to query, for example, who in Congress bought Amazon stock in February, or who sold stocks totaling over $1 million before the market downturn. The bill would also require the system to be accessible through an API.

In April, a review by the non-partisan Campaign Legal Center found that in the earliest months of the coronavirus pandemic, U.S. senators and representatives made thousands of stock transactions totaling over $158 million, with some members making purchases in companies that provide remote work technologies.

Congress’ ownership of individual corporate stocks poses major conflicts of interest and potential for corruption. It’s common for members to own stocks in companies that fall under the jurisdiction of their committee, and even to question corporate CEOs in hearings while owning stock in their companies. The Stock 2.0 Act would make it much easier for the public to get thorough, up-to-date information on these potential conflicts, and it would allow for the creation of private web applications to be built similar to those that can be used for easily looking up campaign contribution information.

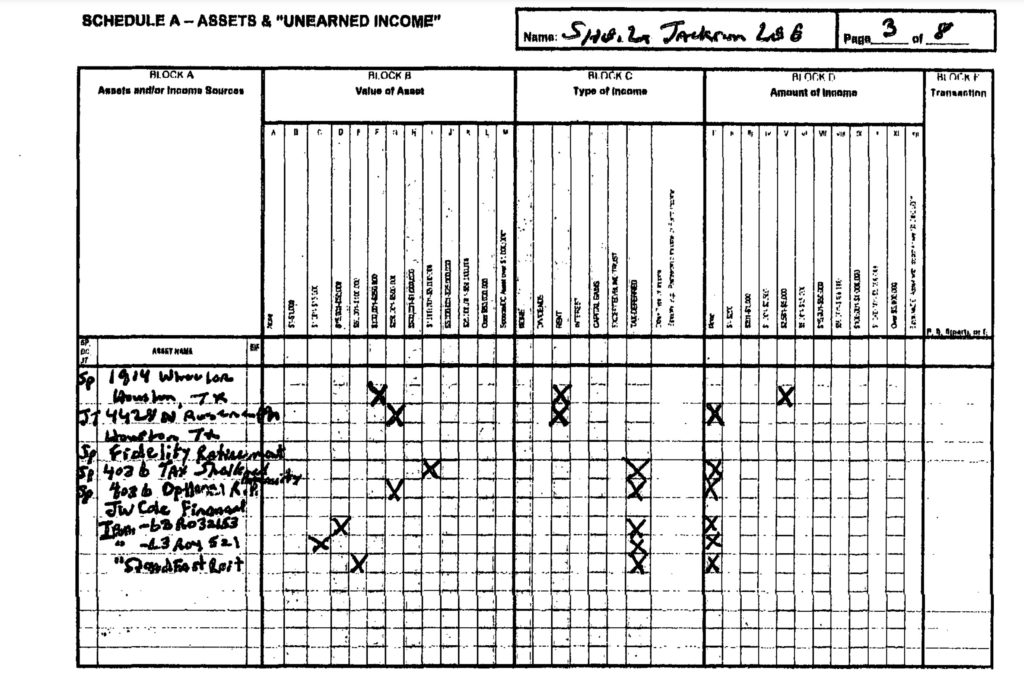

The details of members’ annual financial disclosures would also be required to be accessible through a searchable, sortable website. Currently, members of Congress are allowed to file their annual disclosures using non-standard, handwritten forms that pose major hurdles to individuals who attempt to review them. Handwritten forms are often scanned and uploaded in a way that makes them illegible.

The House Ethics Committee “strongly recommends using the electronic filing system to complete Financial Disclosure Statements and Periodic Transaction Reports,” according to guidelines for members and staff it posted online. However, even a majority of the Republicans on that committee filed their disclosures on handwritten forms last year.

The other section of the bill is a response to reports that several members of Congress managed to get forgivable Paycheck Protection Program (PPP) loans for their personal businesses while many companies have been unable to secure federal help during the pandemic. While reporters have managed to identify some of this funding, it’s impossible to know the full picture without members of Congress and other officials being required to disclose what they receive.

“As Congress is working on the next COVID relief policy and the economic collapse, we’re pushing trillions of dollars of relief out the door,” Gillibrand and Porter said in a video announcing the bill. “Millions of dollars are going right into the pockets of the same people making decisions about relief policy.”

Applications for payments from the federal government in the form of grants, contracts, or loans, including agricultural subsidies, would have to be reported in the financial disclosures required from members of Congress and other officials, under the bill. Such applications, as well as any assistance received, would also have to be reported on an ongoing basis within 30 days of an official receiving them.

Holman said the bill should be non-controversial, but he’s unsure if Congress will pass it quickly.

“Since it’s a disclosure law, I don’t see where the opposition would come from,” said Holman. “The problem is trying to get it on the agenda of Congress. But this is the type of legislation that really should be bipartisan and it really shouldn’t be all that controversial. The prospects all depend on whether we can get their attention on the bill.”

Three Democratic senators have previously proposed banning members of Congress from buying and selling individual stocks while serving in office: Sen. Elizabeth Warren (D-Mass.), in a 2018 reform package titled the Anti-Corruption and Public Integrity Act; and Sen. Sherrod Brown (D-Ohio) and Sen. Jeff Merkley (D-Ore.), who last year re-introduced the Ban Conflicted Trading Act. A House version introduced earlier this year by Rep. Raja Krishnamoorthi (D-Ill.) would next have a potential vote in the House Administration or Financial Services Committees.

Read more from Sludge:

STOCK TICKER: A Critic of Trump’s Postal Policies, Wyden Stands to Benefit from Privatization

Trump Admin Did Little to Prevent PPP Fraud, New Report From House Dems Concludes

Here Are the Billionaires Funding Trump’s Voter Suppression Lawsuits

‘It’s a Secret, a (c)(4) Is a Secret’: Dark Money Powers $60 Million Bribery Scheme in Ohio