The Democrats’ budget reconciliation bill is in limbo, with House party leaders delaying a vote on the bill on Friday, casting doubt over the fate of provisions added back into the plan that would curb prescription drug costs. In a dramatic late-night decision, Speaker Pelosi allowed a vote on the bipartisan infrastructure bill, which passed the House by 228-206, then agreed to wait on a vote on the larger Build Back Better Act, a reconciliation bill, because some Democrats insisted on getting a new budget score for the bill before they would consider voting in favor.

Update: the Build Back Better Act passed the House on Nov. 19 by a vote of 220-213 and moved to the Senate, where the legislation expired in 2022.

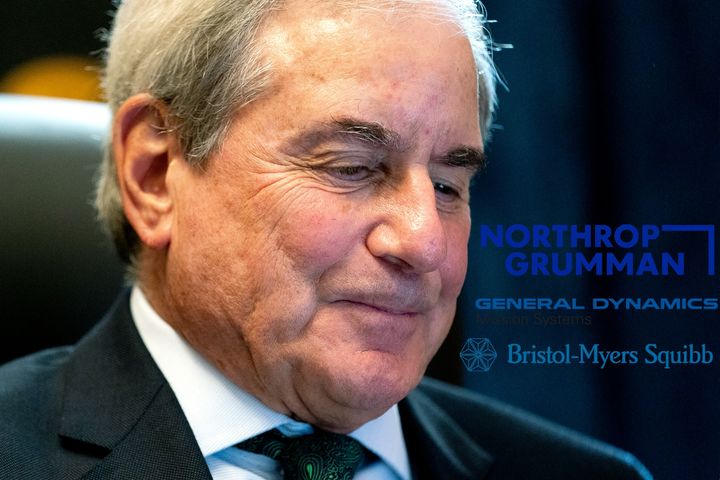

Budget Committee Chair John Yarmuth of Kentucky disclosed on Thursday that he purchased between $2,000 and $30,000 of stock in multinational pharma company Bristol Myers Squibb (BMS), among other stock moves in September. The drugmaker is the top manufacturer of the most commonly prescribed Medicare treatments, according to PharmaNewsIntelligence, with several BMS drugs in the top 10 most-prescribed of all time, including Orencia, which in 2019 received $920 million in Medicare purchases. Since 2019, BMS has sold the cancer treatment Revlimid, which costs Medicare and patients over $4.7 billion a year.

Rep. Yarmuth also bought up to $15,000 each in the stocks of “pure-play” Defense contractors General Dynamics and Northrop Grumman, which receive the vast majority of their revenue from federal contracts. Yarmuth is one of three dozen representatives and nearly a dozen senators who own stock in military contractors that have seen their value skyrocket over the past two decades of foreign wars and congressional appropriations. Yarmuth’s committee writes the annual concurrent budget resolution that declares appropriate budget levels for categories of the government including national defense.

Passage of the reconciliation bill in the House is not guaranteed, as more than enough Democrats have expressed opposition to the bill—and especially to its drug pricing reforms—to vote it down. BMS is a member of several trade associations that have been fiercely lobbying against the widely-popular measures to allow Medicare to negotiate prescription drug prices, including Pharmaceutical Research and Manufacturers of America (PhRMA) and Biotechnology Industry Organization (BIO). The pharmaceutical industry is on pace to shatter its recent high water mark in influence spending, according to OpenSecrets, with PhRMA alone having reported nearly $23 million on federal lobbying through September of this year.

In February, Yarmuth picked up stock in Arena Pharmaceuticals, along with cannabis companies Aurora Cannabis, Canopy Growth Corp, and cannabis pharma firm Tilray. For reasons unnoted in the disclosures, it wasn’t until Aug. 11 that the House Clerk’s office reported other transactions by Yarmuth: in March, he went back for more Canopy Growth stock, and in late May, he bought shares in Amgen. Yarmuth’s Hill office’s communications director did not respond to an inquiry about how the eight-term congressman defends his stock moves as he chairs the committee with jurisdiction over the budgetary effects of legislative action. Yarmuth is retiring next year after representing a district encompassing Louisville, Kentucky since 2007.

Yarmuth is a frequent stock trader, drawing attention in February for his cannabis trades while cosponsoring legislation that would deschedule cannabis. In his disclosure report for 2020 he lists owning dozens of company stocks. His net worth was estimated as of 2018 as topping $17 million.

A columnist with The Atlantic recently went viral on Twitter by highlighting the results of one study finding that members of Congress outperform the stock market by 20%, but overall, findings are more mixed on the record of congressional stock trades. One working paper from last year found that senators’ stock picks slightly underperform the market, and two academic researchers focused on the topic told me in July that the data released by Congress is too limited for detailed analysis of short-term gains.

Still, widespread sentiment has been building on social media against the practice of stock trading by members of Congress, one in 12 of whom have violated STOCK Act this year according to an ongoing series from Business Insider. A poll earlier this year from Data for Progress found that 67% of likely voters support a bill that would ban members of Congress and senior congressional staff from buying and selling individual stocks, a number that rises to 71% when arguments are given in favor and against the measure, including the support of two-thirds of Republicans.

At least three legislative items are languishing in House committees, awaiting action, that would address the conflicts:

- Rep. Krishnamoorthi’s reintroduced Ban Conflicted Trading Act, H.R. 1579, has 21 cosponsors, including some Republican reps, and has a Senate companion again this year sponsored by Sen. Merkley with three cosponsors: Sens. Brown, Gillibrand, and Warnock.

- Rep. Angie Craig’s HUMBLE Act, H.R. 459, has three progressive cosponsors.

- The TRUST in Congress Act, H.R. 336, introduced by Democratic Rep. Abigail Spanberger with GOP Rep. Chip Roy, has 15 House cosponsors.

In March, the three reform items were introduced as amendments to the major Democratic reform package the For the People Act, but the House Rules Committee did not allow them to advance for a full House vote.

Sludge inquired with the Hill offices and committee staff of Rep. Jim McGovern’s Rules Committee and Rep. Zoe Lofgren’s Committee on House Administration to ask if the legislation would be receiving committee hearings this year and did not receive a response. Sludge also asked them if they’d be willing to endorse the current enforcement of the STOCK Act, which has never been used to criminally charge a member of Congress, and did not get a response from the offices of the leading Democrats.

Two years ago, Sludge published the most comprehensive analysis of senators’ stock holdings across five key sectors, in industries they regulate—like health care companies and financial firms—or fund directly—like defense contractors.

Originally posted at The Brick House Cooperative. Photo adapted from image by Stefani Reynolds / Getty Images