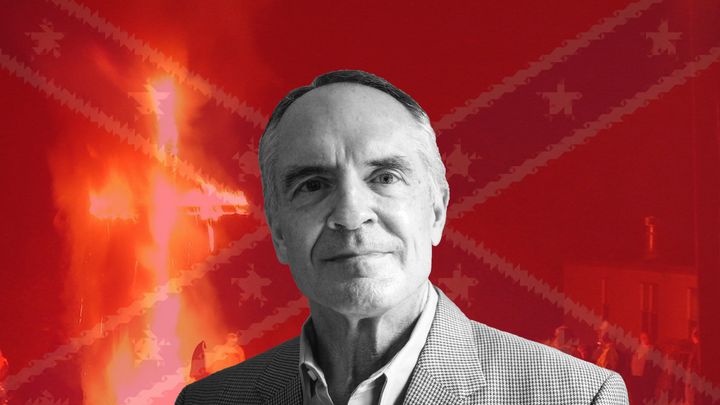

This op-ed was written by Mark Hurtubise, former president and CEO of Inland Northwest Community Foundation.

America’s philanthropy is a trillion-dollar industry that yearly gives billions of dollars to charitable organizations, which in most cases serve worthy community causes. Within the portfolio of options available to donors are donor-advised funds (known as DAFs), the fastest growing vehicle for Americans to set aside billions of dollars for charitable use. A DAF begins with a donor making a tax-deductible contribution to a public charity such as a community foundation or a commercial national charity (e.g. Fidelity Charitable, Schwab Charitable, and Vanguard Charitable), which then creates a separate account for the donor, who may then recommend that the DAF makes grants to IRS-approved 501(c)(3) nonprofits.

According to the latest National Philanthropic Trust report, there are more than 873,000 DAFs in the United States, with total charitable assets held by DAFs surpassing $142 billion in 2019, a 16.2% increase from 2018, and annual grants to IRS-recognized charities from DAFs exceeding $27 billion.

For DAF contributions to qualify as tax deductions, the donor must contractually surrender ownership over them. Thus, the sponsoring commercial national charity or community foundation has final authority over whether a donor-advised recommended grant will be awarded to a charity.

Community Foundation Funds Hate

During fiscal year 2017, while I was president and CEO of Inland Northwest Community Foundation (rebranded Innovia), and for three years thereafter, Innovia’s board approved DAF grants proposed by a wealthy donor to VDare, a white nationalist charity.

VDare, an IRS 501(c)(3) tax exempt charity, has been around for almost two decades. It presents itself as an anti-immigration voice “dedicated to preserving our historical unity as Americans into the 21st Century.” To Vdare, that means make America “white.”

VDare has defined America “almost explicitly, sometimes very explicitly – as a white nation, for white people.” Its principles also include that “America is not a melting pot.” and “Diversity per se is not a strength, but a vulnerability.”

In 2017, VDare went further with its discriminatory assertions about nonwhites when it unabashedly indicted all Hispanics. “There’s ethnic specialization in crime. And Hispanics do specialize in rape, particularly of children. They’re very prone to it, compared to other groups.”

Notwithstanding Inland Northwest Community Foundation/Innovia’s awareness of these hate doctrines and numerous moral and legal reasons not to fund VDare, including the foundation’s unilateral legal authority to deny the donor-advisor’s recommendation, Innovia’s leadership continued financing VDare. In fact, they awarded increasingly larger donor-advised grants to VDare (from $5,000 in fiscal year 2017 to $22,000 in fiscal year 2019). For three years, I advocated for Innovia board members to adopt a hate policy, cease awarding grants to VDare, and rid itself of this donor, who was using the foundation to anonymously finance a hate group, which was contrary to the foundation’s founding values.

Finally, only a few days after the Southern Poverty Law Center (SPLC) and the Council on American-Islamic Relations (CAIR) published their March 2020 report Hate-Free Philanthropy, which included reference to Innovia’s grantmaking to VDare, and regional newspapers ran stories on the Innovia/VDare controversy, Innovia went public with a new hate policy and declared that it would “never again provide funds to organizations that promote hate.”

Commercial National Charities Also Fund Hate Groups

DAFs funding hate is not restricted to community foundations. It’s also a problem with the big national DAF sponsors. Collectively, Fidelity Charitable, Schwab Charitable, and Vanguard Charitable house the most DAF assets of all charities—more than $56 billion. Two recent studies validated that they are supporting hate organizations via their DAFs.

By analyzing the tax returns from 2014 to 2017 of DonorsTrust, Fidelity Charitable, Schwab Charitable, and Vanguard Charitable, Sludge discovered that these four large commercial charities donated close to $11 million via their DAFs to more than 30 anti-Muslim, anti-LGBT, and other SPLC-designated hate groups, many of which disseminate their hate doctrines via online social networks.

In its 2019 report Hijacked by Hate, CAIR identified $18 million given anonymously between 2014 and 2016 by donor-advisors through Fidelity Charitable, Vanguard Charitable, and Schwab Charitable to IRS-approved nonprofits that spread hatred toward Islam and Muslims.

Hide and Seek

Besides the issue of community foundations and commercial national charities supporting donor-advisors, who conceal their identities when grants are awarded from their DAFs to hate charities, there are other problems that justify expanding federal oversight of DAFs.

For decades, philanthropy has existed in a privileged world. It has no stockholders hungry for dividends; pays no federal income tax; has no payout requirement; answers neither to voters, the public, nor the marketplace; and can exist in perpetuity. Thus, DAFs have operated as independent money changers without any serious accountability regarding what they fund.

The Council on Foundations (COF) functions as the accrediting body for community foundations. It has yet to incorporate into its National Standards for US Community Foundations a serious diversity and inclusion policy that extends to community foundation grantmaking. Therefore, if the COF becomes aware that a COF-accredited community foundation is knowingly awarding grants to hate charities, there is no standard that would support a potential sanction against the community foundation, such as the COF issuing a warning that the community foundation’s accreditation may be in jeopardy if the hate funding continues.

This would have helped me immensely when Inland Northwest Community Foundation/Innovia, year after year, funded VDare. Instead, there were no COF repercussions against the foundation when I shared with COF that one of its accredited community foundations was funding a hate charity, VDare.

The IRS’ oversight of 501(c)(3) charities housing DAFs is almost nonexistent. Besides the required annual filing Form 990 (annual tax return for nonprofits) by community foundations and commercial national charities, DAFs function independently of any serious federal regulations.

The Democrats control the House and Senate for the first time in a decade. Along with a Democratic president, this is the ideal time for the nation to be made aware that the underwriting of hate and discrimination polarizing our communities is being subsidized by DAFs. President Biden is ideally positioned to flag this issue and demonstrate to the country DAFs require reform and proper oversight.

Therefore, the proper venue to debate the alarming lack of accountability of DAFs should begin with congressional hearings in 2021. If this is not initiated, I fear some charitable organizations that sponsor DAFs will continue operating unchecked with their funding of hate charities like VDare.

Although it took three years, at least Innovia finally came around and stated it “will no longer fund hate.” It would be too onerous for anyone to go one by one to determine whether each foundation in the U.S. should do the same. That is one of many reasons why Congress in 2021 should schedule hearings on the unsupervised atmosphere of DAFs. If not, DAFs’ treasure troves of billions of charitable dollars will continue being used to finance hate charities, which are abusing too many Americans.

Mark Hurtubise was president and CEO of Inland Northwest Community Foundation from 2005-2017. Prior to that, he was president of two colleges and a practicing attorney.