Arizona is one of 26 states where citizens can initiate legislation through a ballot initiative, and in 2018, residents launched a ballot campaign to bolster resources for public education. The state’s education funding had seen over $1 billion in cuts over the previous decade. According to the National Education Association, Arizona had the eighth-lowest average teacher salary of states, at $47,403.

Supporters of increased education funding undertook a ballot measure that would have raised $690 million more per year for schools through a tax increase on the state’s wealthiest 1% of taxpayers. But while the measure gathered enough qualifying signatures, it did not make it to the ballot that year—the Arizona Chamber of Commerce brought a technical challenge to its wording, after corporations kicked in over $1 million to its campaign opposing the measure. The Arizona Supreme Court ruled 5-2 in August 2018 that a public pamphlet should have used the words “percentage points” rather than the percent symbol, among other issues.

Behind the Arizona Supreme Court’s ruling, reporters Scott Zimmerman and David Armiak found at Exposed by CMD, was a 2017 bill passed by Republicans that required a “strict compliance” legal standard for ballot initiatives. That law signed by Gov. Doug Ducey, in turn, had been supported by the right-wing Barry Goldwater Institute for Public Policy Research, an advocacy group that has received funding from the Koch network, the Bradley Foundation, and other major conservative funders.

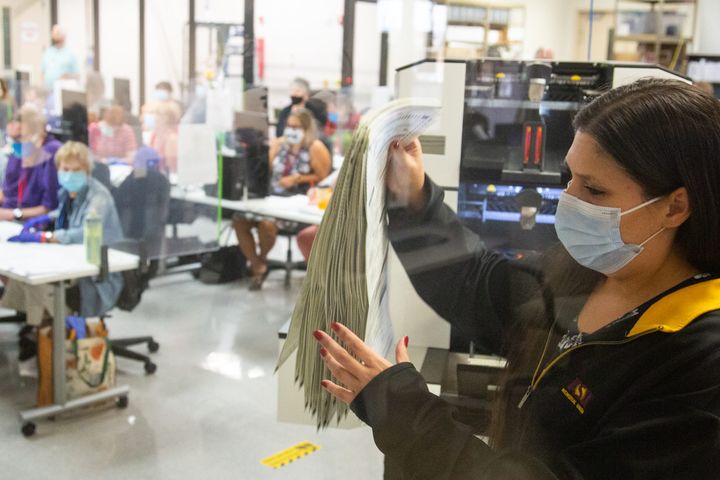

The education measure was reintroduced this year as “Proposition 208, Tax on Incomes Exceeding $250,000 for Teacher Salaries and Schools Initiative,” and was approved by voters by 51.75% to 48.25%, a difference of over 113,000 votes among the over 1.675 million cast. The law establishes a 3.5% surcharge on individuals with incomes over $250,000 or households with incomes over $500,000 “to increase funding for public education.”

In the past few weeks, a pair of lawsuits have sprung up to challenge Proposition 208 as unconstitutional, one filed by the Goldwater Institute on behalf of a coalition of small business groups and legislators, and the other by businesswoman Ann Siner and retired judge John Buttrick. The suits, which have been consolidated, make two claims: one, that Prop 208 clashes with an existing constitutional amendment that caps school funding; and two, that Prop 208 is invalid because tax increases require a two-thirds majority vote by the legislature.

Corrine Rivera Fowler, the director of policy and legal advocacy for the Ballot Initiative Strategy Center (BISC), a progressive 501(c)(4) organization that supports ballot measure campaigns and worked with Arizona advocates on Prop 208, tells Sludge that these suits are yet another effort by opponents to defeat a measure that voters endorsed.

“In the two lawsuits filed, challenging the authority of voters in Arizona to increase their own taxes to fund education, the opinion of BISC is they have no basis,” Fowler said. “The Arizona Constitution clearly provides a path for citizens of the state to propose any ballot measure that they so choose—the Constitution doesn’t specify types of ballot measures that voters can propose or enact. Nowhere does it specify that revenue measures like tax increases can only pass through the legislature—it definitely states that the legislature has authority to raise taxes, but does not say voters do not have that power.”

“We see these efforts across the nation when progressive policies pass by the ballot, from conservatives and others in opposition seeking to repeal the will of voters,” Fowler said. “Voters have had their say through the process of direct democracy and it will be upheld.”

Other state constitutions, like Colorado, do require voters to approve tax increases, but under a strict reading of the Arizona Constitution, voters have the ability to propose any measure. This has included tax measures before: in 2000, Arizona voters approved a ballot initiative to increase sales taxes for education funding, which was then extended by the state legislature in 2018 before it expired in 2021.

“The education system is badly in need of increased funding, and the community has done their duty to organize and engage voters, who responded with support,” Fowler said.

Challenging the legality of measure is the Goldwater Institute, a 501(c)(3) organization that pushes model legislation like “campus free speech” bills and the corporate-interest-driven agenda of the American Legislative Exchange Council (ALEC). Based in Phoenix, the Institute received grants last year of over $5 million and had total assets approaching $7 million, according to its annual Form 990.

The Goldwater Institute has been the lead author of ALEC’s annual state-by-state education report card, which promotes school privatization, according to reporting by the progressive nonprofit Center for Media and Democracy (CMD) and liberal advocacy group Arizona Working Families.

From 2013 to 2016, the Goldwater Institute received a total of $1.4 million from the family foundation of right-wing billionaire Robert Mercer and his daughter Rebekah Mercer, according to Mercer Family Foundation Form 990s. From 2014-16, the Institute was given over $50,000 from the State Policy Network (SPN). The Goldwater Institute is an Arizona affiliate of SPN, a network of right-wing think tanks that shares a funding base with ALEC from donors like the Koch-linked DonorsTrust and the Walton family. A DonorsTrust affiliate, the opaque Donors Capital Fund, funneled over $1.6 million to the Goldwater Institute from 2008-2010, CMD found, making up a substantial amount of its funding. The Bradley Foundation donated $15,000 to the Goldwater Institute in 2018, and the Charles Koch Foundation donated $100,000 in 2016, with the Charles Koch Institute chipping in a total of $22,500 in 2016 and 2017.

While the Goldwater Institute receives major funding from out-of-state conservative donors, many of its funders are Arizona-based family foundations whose founders could be affected by the tax increase the Institute is battling to overturn. From 2014-18, the Bill and Marian Cook Foundation donated a total of $525,000 to the Goldwater Institute. A Goldwater board member, Marian, with her late husband Bill, owns the ranch property where the 1985 movie “Silverado” was filmed, among other Westerns. Other Goldwater Institute family foundation donors that are registered in Arizona include the Edmunds Family Foundation, the Herbster Family Foundation, the Nehring Foundation, and the Robert and Marie Hanen Foundation.

Several Arizona Republican legislators joined the Goldwater Institute’s suit, including Senate President Karen Fann and House Speaker Rusty Bowers. The other legal challenge to Prop 208’s constitutionality was brought by Ann Siner, CEO of upscale consignment shop chain My Sister’s Closet, and John Buttrick, a retired Maricopa County Superior Court judge and former Libertarian Party national committeeman.

Fowler said that BISC may file an amicus brief or sign on to one opposing the lawsuits against Proposition 208.

The author of the measure, David Lujan of the liberal think tank Arizona Center for Economic Progress, said of the lawsuits, “It’s absurd, in my opinion, 1.7 million Arizonans voted to pass Proposition 208 to put money in the schools and to circumvent the Legislature because they’re tired of waiting on the Legislature to invest in our schools.”

Lujan tells Sludge that the two lawsuits have been consolidated into one, and that the case is now at the lower court, the Superior Court of Arizona. He says the plaintiffs have asked for injunctive relief to stop the tax from going into effect on January 1, so there is a brisk briefing and oral argument schedule to resolve that before the end of the year. The coalition supporting Proposition 208 and Lujan as an individual taxpayer have been allowed to intervene as interested parties, and Lujan says he expects that the tax will be allowed to go into effect as the lawsuit works its way through the courts over what could be a lengthy period of time.

This post was updated on Dec. 16 at 9:50 pm ET to include further comments from David Lujan on the legal status of the lawsuit challenging the legality of Proposition 208.