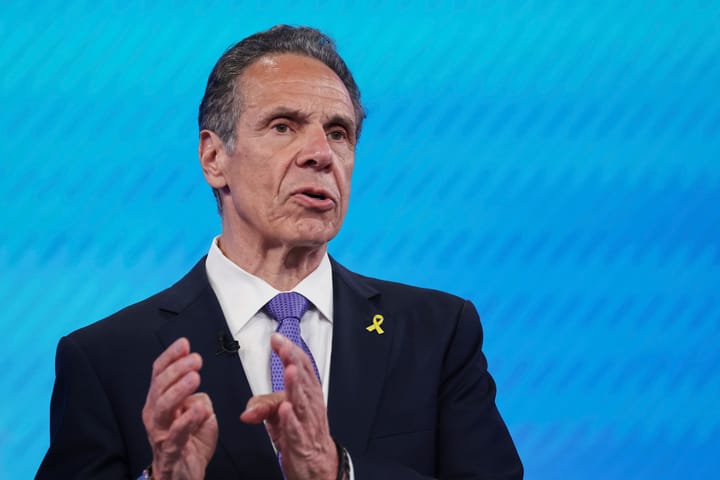

A couple of years ago, Westchester County real estate developer Larry Regan bought a $25,000 ticket to a steak dinner he did not attend. The dinner was a Manhattan fundraiser for New York Gov. Andrew Cuomo, and Regan had been lobbying the state seeking real estate tax credits, according to The New York Times. He ponied up and didn’t go.

“About 100 people mingled in a crowd that included the state budget director, Robert Mujica, and the governor’s top aide, Melissa DeRosa, before sitting down at more than a dozen tables for two slices of filet mignon, vegetables and what one attendee described as a ‘little peaked salad,’” the NYT wrote.

The scene was a familiar one in New York politics, where state lobbying interests and public servants mix amid high-dollar contributions to Cuomo. The governor had just a few months earlier been re-elected to his third term, signaling that the secretive glitzy fundraiser was really more timed to coincide with the state budget process—and replenishing his coffers after a costly 2018 campaign.

Several ticket buyers told the NYT that their lobbyists had recommended they make the donations in order to have their interests heard in Albany. But Cuomo spokesperson Richard Azzopardi took umbrage at the suggestion of a quid pro quo, saying that any Cuomo contributors there to seek government favors should “fire their lobbyist and get their head examined.”

While Cuomo has raked in well over $100 million for his campaigns and raises yet more through the New York Democratic Party, that funding is modest in comparison with the political power he’s amassed through his control of opaque multi-billion-dollar annual state subsidy programs. These wide-ranging economic development programs are overseen by the Empire State Development corporation, whose board is supposed to be composed of two ex-officio members and seven members appointed by the governor, with the consent of the Senate. Combined with the governor’s high degree of budgetary authority, Cuomo’s ability to start these rich multi-year subsidies incentivizes powerful real estate interests to stay close through campaign donations and lobbying.

Pay-to-Play History Under Cuomo

Cuomo’s proximity to scandal dates back to his administration’s first term, when he abruptly shuttered the anti-corruption Moreland Commission after less than a year just as it turned its focus to the executive branch. Corrupt acts by Cuomo’s close allies were ongoing through his second term, with bid-rigging convictions around the ineffective “Buffalo Billion” program, in which his major donors benefited. Cuomo amassed his campaign war chest with at least $1.35 million given from 15 real estate billionaires and their spouses, a report by the nonprofit Public Accountability Initiative found.

The National Institute on Money in Politics (NIMP) tallied Cuomo’s career haul from the real estate industry at nearly $19.3 million, around 14% of the over $136 million total they’ve counted for his campaigns. That count is just a fraction of the full amount Cuomo has taken in from real estate industry-linked donors—further analyses could incorporate donations from family of industry executives and webs of pop-up LLC affiliates.

For example, one of Cuomo’s top real estate benefactors has been RXR Realty, with at least $185,000 contributed according to NIMP’s FollowTheMoney. Of its owner Scott Rechler, Politico’s Bill Mahoney reported in 2018, “Rechler himself has given the governor only $60,000 since 2015, though his wife has contributed $65,000 and two of his children have donated $25,000 apiece. Four limited liability companies tied to his real estate firm RXR Realty have also given.” Since then, Rechler’s individual total given as a Cuomo contributor has risen to nearly $144,000. In addition, according to NIMP data the real estate industry has contributed over $5.4 million to the state Democratic Party, which for the past decade Cuomo has controlled through allies like Chair Jay Jacobs, and millions of dollars more to the campaign of Lieutenant Governor Kathy Hochul. Real estate donors have put in over $100 million to New York state elections since 2000.

Cuomo’s Secretive Subsidies

New York State handed out $4.4 billion in corporate subsidies in 2018, with local governments giving $5.6 billion more, according to the nonpartisan Citizens Budget Commission. However, the state government does not release detailed data on its subsidy programs for the public to access and for watchdogs to analyze which companies received benefits. While there is no official dataset available to know if Cuomo’s real estate industry donors got subsidies from entities controlled by the governor, Sludge confirmed that several of them have received public subsidies to develop properties in the state.

LLCs linked to longtime Cuomo donors at large real estate companies received subsidies from New York City, according to data for fiscal year 2020 from the Economic Development Corporation, a nonprofit organization whose board chair is appointed by the New York City mayor and whose budget mostly comes out of the city’s capital fund. Multiple billion-dollar projects of LLCs affiliated with the Related Companies, according to SEC filings, received assistance as payment in lieu of taxes for development in Manhattan’s Hudson Yards. Billionaire Stephen Ross, the Related Companies’ founder and chair, and his company have contributed $70,000 and $30,700 respectively to Cuomo’s campaigns, according to NIMP.

Two LLCs affiliated with real estate manager Brookfield Properties named BOP SE and BOP NE, totaling nearly $4.6 billion in project costs, are receiving city assistance with mortgage recording tax. Brookfield Properties has donated at least $75,000 to Cuomo over his career. Real estate developer Extell’s LLC is receiving city subsidies for a $745 million project as the company has donated over $75,000 to Cuomo, and an LLC formed by Tishman Speyer Properties is receiving city subsidies for a $706 million project, having contributed nearly $96,000 to the governor.

“If we had full subsidy transparency, New Yorkers would easily be able to view the number of affordable housing units or jobs created by companies receiving real estate tax breaks,” Tom Speaker, policy analyst at the nonprofit Reinvent Albany, told Sludge. “But even better than more transparency would be simply ending the billions of dollars in tax breaks that real estate receives. We don’t need more research to tell us what we already know: Most of these subsidies are a waste of taxpayer dollars.”

Last month, the Brookings Institute released new research that the so-called “opportunity zones” that Cuomo has embraced likely have no effect on employment, earnings, or poverty. Speaker wrote recently that the zones “amount to giant giveaways to corporations and real estate developers, and take funds away from schools and vital public services.”

Good government groups in New York have called for the governor’s office to follow through on a proposal to create a “database of deals” for basic transparency around the vast subsidies. A law mandating public disclosure would be ideal, and Democratic Sen. Leroy Comrie of Queens recently reintroduced a bill to establish one, but the measure currently seeks a sponsor in the state Assembly.

Speaker notes that New York City’s Economic Development Corporation does at least publish its subsidy data once annually, though the information could be enhanced and made more accessible. A glance at the NYC data shows how these projects bring together the city’s power players. Subsidies went to projects whose costs totaled in the hundreds of millions of dollars involving Yankee Stadium, Bank of America, New York University, NBC Universal, and The Hearst Corporation. In 2018, New York City economic development costs totaled $3.2 billion, the Citizens Budget Commission found.

To restore accountability to these programs, which have been criticized for reasons beyond the high-profile corruption convictions, Speaker also recommends the legislature hold an oversight hearing on business subsidies and pass legislation introduced by Sen. Michael Gianaris of Queens to repeal New York’s Opportunity Zone tax break.

Cuomo is currently the subject of multiple investigations: the first, led by New York Attorney General Letitia James’ office, into allegations of sexual harassment by at least eight women; second, by outside counsel hired by Democrats in the state Assembly, also into the inappropriate behavior; third, by the FBI, reportedly investigating Cuomo’s role in shielding hospital donors from Covid liability; fourth, by the U.S. attorney’s office in the Eastern District of New York, reportedly focusing on the actions of the governor’s coronavirus task force.

Cuomo has said he’s not stepping down, despite widespread calls for him to resign from other state Democratic leaders (including Senators Schumer and Gillibrand)—though his ability to run and compete in next year’s Democratic primary could change entirely, depending on the outcomes of any of the investigations. The New York impeachment process would begin with a majority vote in the state Assembly, where the Majority Leader Carl Heastie, who has been a Cuomo ally, convened a special judicial committee with ties to Cuomo.

Update: on May 6, Empire State Development published a database of deals. Good government watchdogs are evaluating the long-delayed dataset.

Originally posted at The Brick House Cooperative