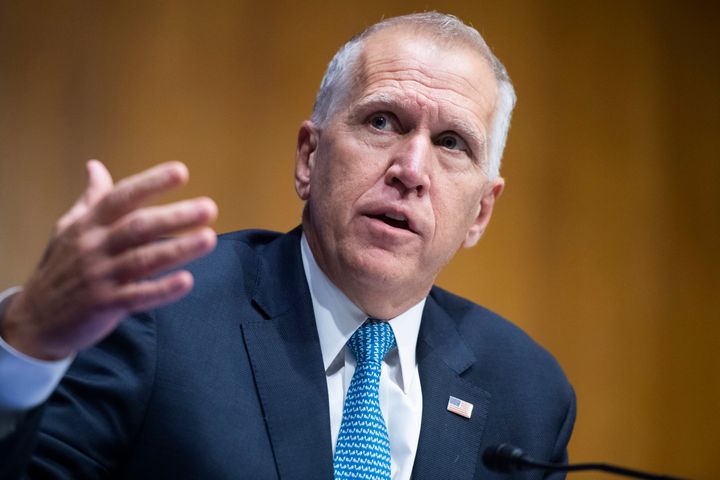

Starting this week, North Carolina TV viewers may notice a flattering new ad spot about their Republican U.S. senator, Thom Tillis, who is facing a competitive re-election fight this November against Democrat Cal Cunningham.

The ad, which is paid for by banking industry lobbying group the American Bankers Association (ABA), praises Tillis for supporting the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

“Thom’s leadership for the CARES Act means thousands of North Carolina jobs are protected,” a narrator says over images of workers in blue collar jobs. “From the restaurants we supply to farmers that depend on us and the people we employ, plain and simple, Thom Tillis is fighting hard for us.”

What the ad doesn’t say is that Tillis helped to get two ABA-supported deregulatory provisions added to the CARES Act, helping banks boost their profits during the pandemic. Both of the provisions had been longtime wishlist items for the banking industry. The ad was funded with a $500,000 expenditure by ABA and sponsored by the North Carolina Bankers Association.

The provisions come directly from a bill Tillis co-introduced in March with three Republicans Senators called the Community Bank Regulatory Relief Act.

One of the provisions is a reduction in the minimum amount that banks with $10 billion or less in total assets—so-called community banks—are required to hold in reserve in order to protect themselves against becoming insolvent. The reduction, which is one percentage point, is a furthering of one of the sections of Sen. Mike Crapo’s (R-Idaho) banking deregulation bill that President Trump signed into law in 2018. The Crapo bill created a framework for calculating reserves called the Community Bank Leverage Ratio (CBLR) that allowed banks under $10 billion in assets to set aside 9% rather than having to comply with more complex, risk-based reserves rules established by the international Basel Committee on Banking Supervision after the financial crisis.

All but the 127 largest U.S. bank holding companies could potentially qualify to use the CBLR based on their size by total assets, according to Federal Reserve data. The 9% CBLR had been set to take effect on March 31, according to a Federal Deposit Insurance Corporation rule finalized in September 2019, but the CARES Act reduction was passed just in time to stop the 9% level from ever taking effect.

The Tillis-backed reduction in the CBLR will be in place through the end of the year and will return to 9% in phases throughout 2021, according to the legislative language. In a press statement, Tillis said the measure “would give community banks extra resources to meet their financial needs during the coronavirus pandemic.”

While Tillis and his colleagues promoted the deregulatory measure as a pandemic response, the ABA has been pushing for an 8% rate since long before the COVID-19 crisis. Since at least December 2019, the ABA’s website has said it “[hopes] that as the FDIC becomes more comfortable with the CBLR, it will reassess this rule and allow community banks with ample capital to use an 8% ratio.”

Financial reform advocates say that having lower reserves could cause bank failures if borrowers are unable to meet their obligations during the pandemic.

“Watering down capital standards, the crucial buffer against failure, is the wrong thing to do, and mainly a way for banks to juice profits,” said Marcus Stanley, policy director at Americans for Financial Reform. “Hundreds of community banks failed during the financial crisis and it’s entirely possible banks will get into trouble as the pandemic-induced recession drags on.” A study by the Federal Reserve Bank of San Francisco found that ten years after the 2007-08 financial crisis, U.S. real GDP was 12% lower than projected by pre-crisis trends.

The other provision from the Tillis bill that was added to the CARES Act delayed the implementation of a new accounting standard for financial institutions called Current Expected Credit Losses (CECL) that will require them to account for all losses they expect from their loans, rather than only the losses that have actually incurred. The ABA says on its website that it believes CECL accounting “presents operational complexities that can significantly increase costs at banks of all sizes” and could increase the impact of industry-wide trends, making hypothetical downturns more severe.

The ABA has been lobbying against CECL since at least the fourth quarter of 2018, and Tillis first introduced legislation to delay its implementation in May 2019.

Stanley told Sludge that delaying CECL is another form of easing regulations on banks. “There’s no evidence that easing it will help lending to consumers, whose main problem is lack of income, not credit,” said Stanley.

While the Tillis-sponsored CBLR and CELC relief provisions will both begin expiring at the end of the year, ABA is already lobbying Congress to extend them.

A Friend of the Banks

Tillis, a member of the Senate Committee on Banking, Housing, and Urban Affairs, represents North Carolina, where several top banks like Wells Fargo and Bank of America are headquartered. Since joining Congress in 2014, Tillis has been a reliable ally to the banks and has consistently received campaign contributions from bank executives and PACs.

In January 2019, Tillis wrote an op-ed for American Banker blaming a surcharge on the largest banks that was put in place by regulators after the 2008 financial crisis for causing a downturn in the stock market that occurred at the end of 2018. The surcharge, known as G-SIB, requires banks determined to be systemically important to put aside more money in reserves. It applies to only a handful of the largest bank holding companies in the U.S., including JP Morgan Chase, Goldman Sachs, and Bank of America. Tillis provided no evidence connecting the stock market moves to the G-SIB, writing that “several market experts” had pointed to it as a culprit.

At a 2017 hearing on the Wells Fargo account fraud scandal, Tillis lobbed softball questions at the company’s CEO, Tim Sloan. “I want to talk more about how you focus on the customer and make this very easy for them to recover from,” Tillis said, setting up Sloan to talk about the ways the bank was trying to improve its image with its customers. Wells Fargo’s PAC and employees have given Tillis $80,510 over his career and is his fourth largest career donor.

Tillis has received $56,400 since 2019 from PACs and employees of Goldman Sachs, which he has defended as a firm that goes to great lengths to “employ the little guy.” Goldman Sachs is Tillis’ top donor this cycle, according to the Center for Responsive Politics.

Tillis is one of three senators to be endorsed this year by a super PAC called Friends of Traditional Banking, which called him a “champion on the Senate Banking Committee.” The group does not typically spend money on races, but instead calls on bankers across the country to deliver them a “money bomb” of $300,000 – $500,000 in contributions.

Tillis’ November opponent, Democrat Cal Cunningham, has received his largest share of campaign contributions from liberal conduit organizations like Democracy Engine and J Street, as well as from employees of universities. The North Carolina Senate race is currently considered a “toss up” with Cunningham having a slight lead in multiple recent polls.

Read more from Sludge:

Trump Admin Did Little to Prevent PPP Fraud, New Report From House Dems Concludes

Chris Coons’ Support of Corporate Immunity Could Benefit His Private Equity Donors

Congressional Leaders Are Raising More Dark Money Than Ever Through Their Super PACs

EXPOSED: Reps Pass Bills That Benefit Their Own Private Companies

As Markets Crashed, DeVos Sold Shares in Secretive Cayman Island Fund