Treasury Secretary Steve Mnuchin made hundreds of millions in the wake of the 2008 financial crisis by executing mass foreclosures as the CEO of OneWest bank. Now, as he takes the helm of an unprecedented bailout fund enacted in response to the coronavirus crisis, he’s in a position to profit once again.

The coronavirus stimulus bill gives Mnuchin broad authority over a $454 billion slush fund for bailing out large U.S. businesses. Lobbyists and policymakers are still working out the rules of which companies will qualify, but in its design, the Mnuchin-led fund is for assisting large businesses with “investment grade” debt by providing a Federal Reserve backstop. Companies that could receive small business relief under other sections of the law would not be eligible, and there are separate provisions for providing financing to mid-size businesses, states and municipalities.

Mnuchin, who is worth approximately $300 million, has much of his wealth tied to the stock prices of large corporations. According to his 2019 financial disclosure, Mnuchin owns up to $132 million worth of shares in exchange-traded S&P 500 funds, which are composed of stocks of 500 of the biggest American companies. His investments include between $36 million and $102 million in Vanguard S&P 500 ETF and between $6 million and $30 million in Ishares Core S&P 500 ETF. His funds are held across multiple accounts, including several family trusts and the Steven Mnuchin Dynasty Trust I.

Companies in the S&P 500 Index that are likely to receive assistance from Mnuchin’s fund include Boeing, Southwest Airlines, Hilton, Walt Disney, Royal Caribbean, and MGM. However, the mere existence of the fund may provide more of a boost for the index’s price than the assistance provided to particular companies. The S&P 500 surged by 10% last week after Congress struck a deal on the coronavirus package, its biggest rally since March 2009, according to Yahoo Finance.

As Alexander Sammon at The American Prospect reports, Mnuchin’s power comes not just from the massive sum of money he will control for helping big businesses of his choosing, but also from the broad discretion he will have to set the terms for companies that receive support:

For the airline bailout, it’s up to Mnuchin as to whether or not the government will seek an equity stake in exchange for an expedited check (he’s indicated they might, but he’s leaving it to the companies themselves to suggest what form that would take). For the prohibition on stock buybacks, limits on executive compensation, or any other condition for bailout money recipients, Mnuchin can simply waive those requirements as he sees fit. He now wields extraordinary agency in an economy that’s hanging in the balance, dependent on government largesse. Mnuchin, the unelected former Goldman Sachs banker, Hollywood financier, and campaign money man, may well be the most powerful person in Washington.

The CARES Act includes a provision to protect against conflicts of interest, but it will not stop Mnuchin from helping components of the funds he is invested in. The provision prohibits companies owned by senior administration officials, including Mnuchin, the Trump family, and members of Congress from receiving support from the bill. However, Mnuchin’s investments will not apply because he owns shares of the funds, not the component companies, and even if he did own the corporate stocks he would not hit the minimum thresholds for ownership stakes specified in the bill.

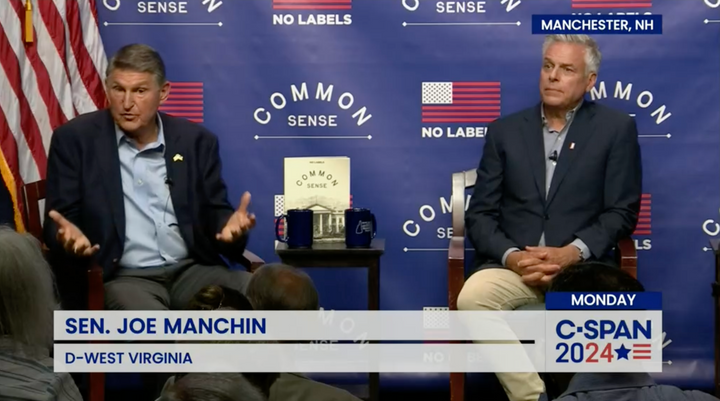

Mnuchin was one of the main architects of the CARES Act, along with Democratic and Republican congressional leaders and White House Legislative Affairs Director Eric Ueland. In an article about how the bill came together, Politico explains that Mnuchin was seen as the only senior White House officials with a good enough relationship with congressional Democrats to take part in the negotiations. The final contours of the deal, including the details of the corporate bailout fund, were finalized in marathon, late-night sessions between Mnuchin and Sen. Chuck Schumer (D-N.Y.).

“Mnuchin and Schumer ended the night saying they were very, very close,’ and both predicted a deal on Tuesday,” Politico reports. “The following day, Wall Street soared, with the Dow Jones Industrial Average rising 11 percent, its second biggest day ever.”

Related: