In a 2012 television ad, Rep. Richard Neal (D-Mass.), the new chair of the House Ways and Means Committee, declared victory over corporate offshore tax avoidance.

“There are American companies who have chosen to move to Bermuda and the Cayman Islands for the purpose of sophisticated tax avoidance,” Neal says in the ad. “I filed legislation to address that issue, and we won.”

Despite his claim, none of Neal’s bills on tax avoidance have ever become law or even received a vote in the tax code-writing Ways and Means Committee, of which he has been a member for the past 26 years. Even from 2007 to 2010, when the Democrats controlled Congress and Neal was chairman of the Ways and Means Select Revenue Subcommittee, his bills on the issue did not advance in the legislative process.

While Neal has talked up his bills to stop corporate offshore tax avoidance and called out companies that engage in the practice, a Sludge review of Federal Election Commission data shows that his re-election campaigns pulled in large—often maxed-out—contributions from PACs and individuals affiliated with some of the top corporate tax dodgers in the U.S., including many of the companies that he has singled out for criticism.

Neal’s office did not respond to an inquiry into the claim made in the ad and other questions about his legislative record and campaign fundraising.

U.S. corporations in the Fortune 500 hold about $2.6 trillion in earnings overseas. The Tax Cuts and Jobs Act of 2017 has resulted in about 17 percent of that money being repatriated, but there is still a massive amount of cash parked overseas in foreign subsidiaries. Putting an end to this practice and repatriating and taxing the remaining funds would go a long way towards financing the proposals that Neal says he plans to pursue as committee chairman, including an infrastructure investment package.

Neal, who was first elected to Congress in 1988, has introduced legislation on corporate tax avoidance going back at least to 2002, a fact that he often highlights in campaign ads, floor speeches, and on the biography page on his House website.

In the 107th, 108th and 109th Congresses, Neal introduced the “Corporate Patriot Enforcement Act,” a bill that sought to end corporate inversions whereby corporations avoid paying taxes in the U.S. by reincorporating in a foreign country. In the 110th Congress he introduced a bill to amend the tax code so that management and administrative activities would not be taken into account when considering whether a company has sufficient business activity abroad to avoid being treated as an expatriated entity. From the 110th Congress to the 114th, Neal introduced a bill to prohibit offshore reinsurance companies from avoiding taxes on premiums paid by U.S. customers. Each of these bills ultimately met the same fate: They were referred to the Ways and Means Committee with no further action taken.

For the first time since 2002, Neal did not introduce any bills on offshore tax avoidance in the 115th Congress, the first session during which he was the top-ranking Democrat on the Ways and Means Committee, and he has not introduced any so far in the still-young 116th session.

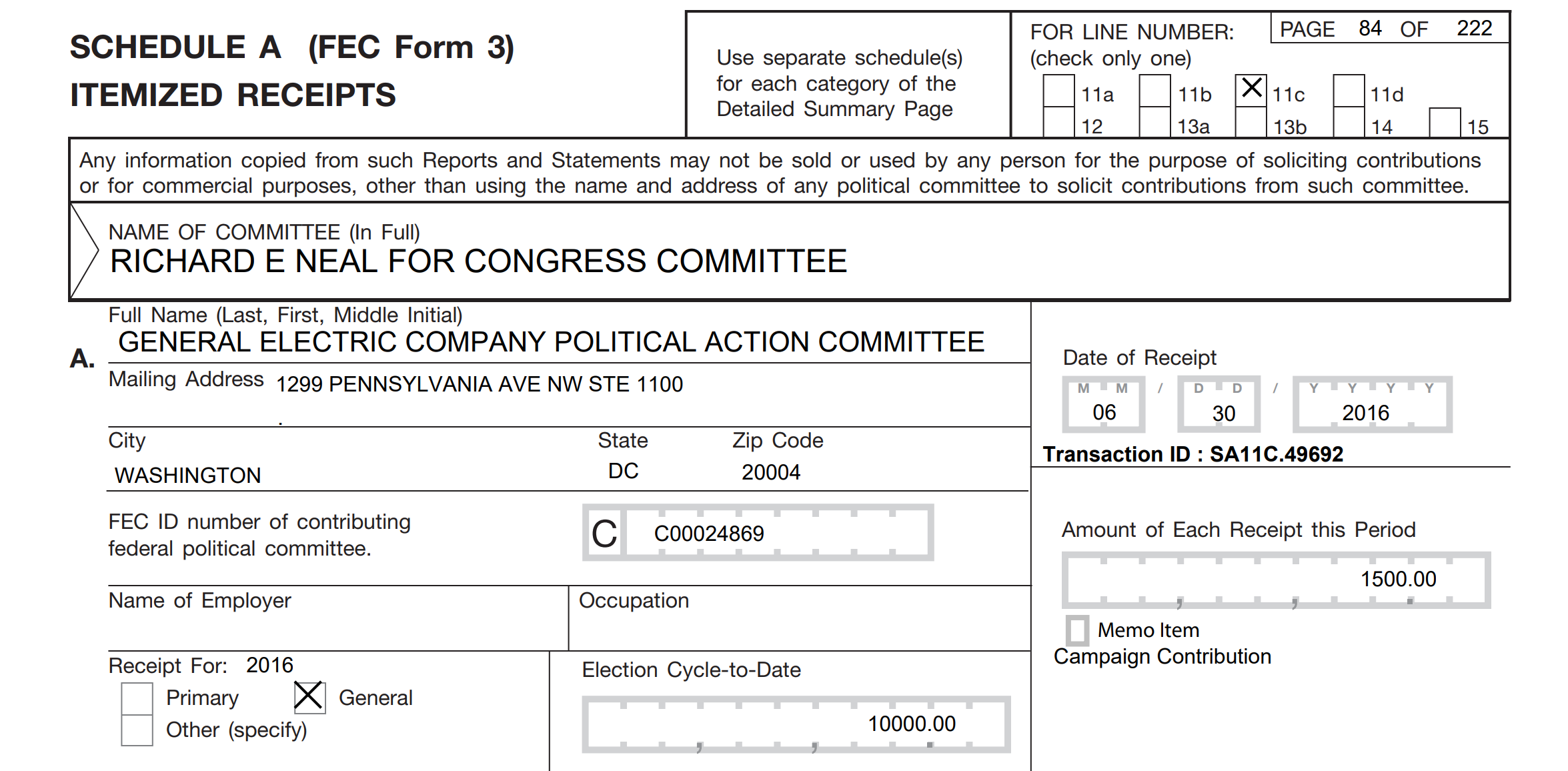

Massachusetts-based General Electric, one of America’s largest corporations, is well-known for its tax-dodging strategies, including holding large amounts of cash in foreign subsidiaries. From 2008 to 2015, GE had a negative effective tax rate and held as much as $82 billion in untaxed profits overseas. GE’s PAC has been one of Richard Neal’s largest donors throughout his career, giving his campaigns $76,500 over the course of his career, while individuals employed by GE, including top executives, chipped in another $27,000. The company has also contributed the maximum of $10,000 to Neal’s leadership PAC, The Madison PAC, during every election cycle since 2008.

In the first three quarters of 2018, General Electric reported spending nearly $3.5 million on lobbying the federal government. Disclosures filed with Congress show that the company discussed tax issues with members of Congress, including “Corporate Tax Reform” and “Taxation of International Operations.”

Since the early 2000s, American construction equipment manufacturer Caterpillar has reported most of its profits from the sale of U.S.-manufactured replacement parts under a wholly-owned Swiss subsidiary, allowing the company to dodge U.S. taxes on those earnings. From 2000 to 2012, according to a 2014 case study from former Sen. Carl Levin (D-Mich.), Caterpillar used its Swiss subsidiary to avoid paying $2.4 billion in taxes. The Illinois-based company has contributed $22,500 to Richard Neal’s campaigns through its PAC since 2007.

One of the companies that Neal has repeatedly criticized for using offshore tax havens is Tyco International, a company that, until its merger with Johnson Controls International in 2016, operated out of Exeter, New Hampshire, and manufactured a range of products including medical supplies, security systems, and undersea fiber optic cables. In a speech on March 5, 2003, Rep. Neal castigated Tyco for setting up a subsidiary in Bermuda that had allowed it to avoid paying $400 million in U.S. taxes. Rep. Neal has taken $14,000 in campaign contributions from the PACs of Tyco and Johnson Controls since 2010.

Neal has been particularly critical of companies that use overseas tax shelters but still receive government contracts, calling such companies “traitors.” In a 2002 report, Neal highlighted five active government contractors that had recently completed corporate inversions to avoid paying U.S. taxes. Following the report, Neal took large campaign contributions from some of those companies’ PACs and executives, including PricewaterhouseCoopers ($59,000) and Accenture ($7,000).

Related: