The Wall Street billionaire who is in charge of helping Trump pick financial regulators and other important positions is getting even more enmeshed in one the largest, most controversial and possibly fraudulent cryptocurrency projects.

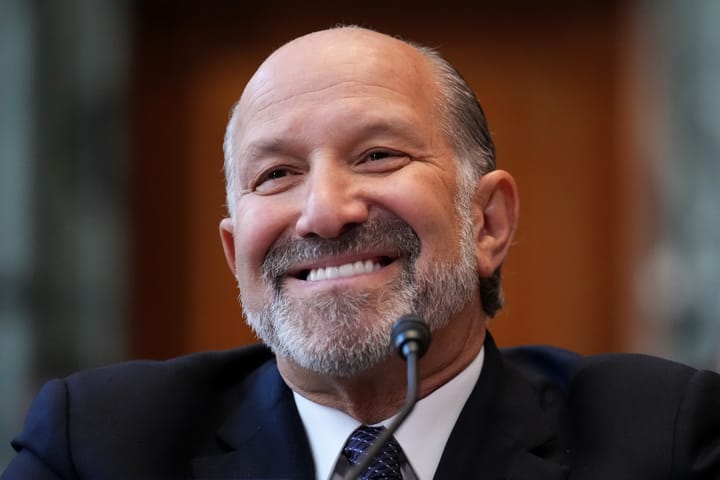

Transition co-chair Howard Lutnick is the CEO of financial firm Cantor Fitzgerald, which is pursuing a plan to have its Bitcoin financing program supported by Tether, the largest cryptocurrency stablecoin. According to Bloomberg, Cantor Fitzgerald’s Bitcoin financing program, which will lend money to clients who provide Bitcoin as collateral, will launch at $2 billion and is expected to grow to tens of billions of dollars. A major Trump fundraiser, Lutnick is also Trump’s pick for secretary of Commerce.

Lutnick and Cantor Fitzgerald are already highly enmeshed with Tether, a popular tool for drug cartels that is reportedly under federal investigation for possible violations of sanctions and anti-money laundering regulations.

🔑Unlock this post with a free trial>>

Tether claims that it holds reserves for all of the $132 billion worth of stablecoins it has issued and that holders could exchange their tokens for U.S. dollars, but Tether has never submitted to a third-party audit and many industry observers doubt that all the reserves actually exist. Lutnick, however, has been a prominent industry voice vouching for Tether’s soundness.

“They have the money they say they have,” Lutnick said in an interview with Bloomberg earlier this year. “I’ve seen a whole lot and the firm has seen a whole lot and they have the money.”