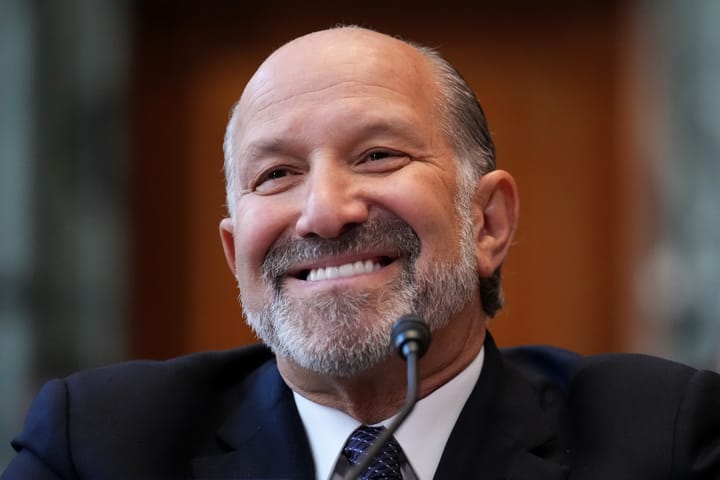

Cantor Fitzgerald, the financial firm controlled by the family of Commerce Secretary Howard Lutnick, is deepening its investments in assets tied to Trump administration policies. In the second quarter of this year, the firm bought hefty amounts of shares in a Bitcoin fund and stock in companies Robinhood, Alibaba, Tesla, chipmaker AMD, Apple, and Trump Media, according to its latest Securities and Exchange Commission filing. Lutnick has been a top cheerleader in the media of the Trump administration’s tariff policies, which can shake the stock prices of companies, and has aided the administration’s plans for a Strategic Bitcoin Reserve.

Lutnick, who had run Cantor Fitzgerald since 1991 as CEO and president, handed control of the firm to his sons Brandon, now CEO, and Kyle, vice chairman, upon his Senate confirmation in February. In May, Lutnick divested his ownership interest in the firm under his ethics agreement. Lutnick has been deeply entwined with President Trump’s frenetic tariff plans, as detailed a recent New Yorker profile, and the Department of Commerce is responsible for implementing and enforcing tariffs as set by the president, the U.S. Trade Representative, and other agencies.