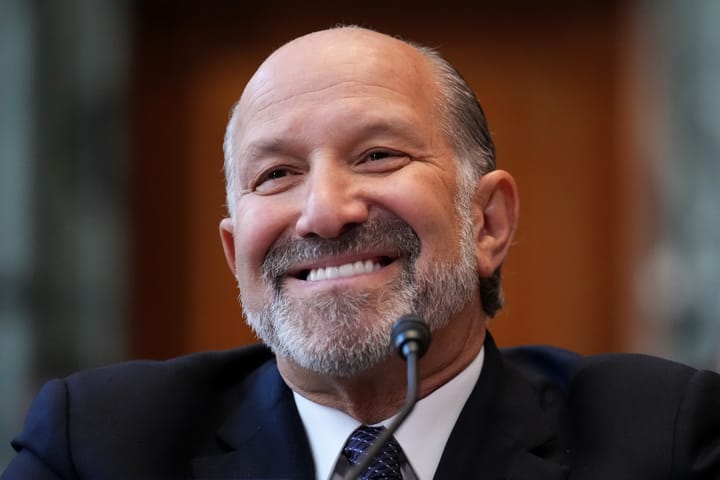

While Commerce Secretary Howard Lutnick was helping the Trump White House develop plans to establish a national Bitcoin reserve, his family-run financial firm Cantor Fitzgerald significantly increased its investment in Strategy, the top corporate holder of Bitcoin, whose co-founder has been the leading proponent of creating a strategic crypto reserve focused on Bitcoin.

The Bitcoin-company stock purchases were identified in an Securities and Exchange Commission filing by Cantor Fitzgerald posted yesterday and covering the first quarter of this year, flagged by research from the progressive government watchdog group Accountable.US.

After being confirmed to lead the Department of Commerce, the billionaire Lutnick signed an ethics agreement stating that he would resign from his CEO positions with Cantor Fitzgerald and divest from certain assets, though interviews by Bloomberg around his nomination suggested that he would still be able to exert control over his majority family-held businesses.

The SEC disclosure examined by Accountable.US shows that from Q4 2024 through Q1 2025, Cantor Fitzgerald increased its total investment in the Bitcoin company Strategy, formerly called MicroStrategy, by over $568 million, reaching over $2.1 billion. This amount includes boosting its holding of regular stock in Strategy by $304 million during that period. Cantor Fitzgerald businesses operate in a number of financial services fields, but in this portfolio, the Strategy stock holdings now make up almost 45% of its total.