Over the past week, many people have raised the prospect of “insider trading,” sparked by a spike in trading volume that preceded President Trump’s social media post on the morning of April 9 that it was a good time to buy. A few hours after he posted, Trump announced he would be pausing certain tariffs for 90 days, news that sent the S&P 500 on a one-day jump of 9.5%.

The tantalizing question is whether Trump allies—administration officials, members of Congress, or supporters from the investment industry—might have been given advance notice to take positions in assets, like exchange-traded funds (ETFs), that saw their values soar.

Today, one Trump ally, Rep. Marjorie Taylor Greene (R-Ga.), released a financial disclosure showing nearly two dozen stock purchases made on April 8 and 9, just before Trump’s announcement.

Over the past seven-plus years, many bills have been introduced in Congress that would have greatly limited the ability of members of Congress and the executive branch to trade, or own, stocks and other shares like ETFs. The lax ability for executive branch officials to buy stocks and other securities could have been dramatically constrained, if these ethics measures had been signed into law.

Poll after poll shows that banning stock trading, or ownership, by government officials is highly popular. Many of the bills have been sponsored by the rank and file of both parties, and have been co-sponsored by scores of House members. According to a Sludge review, more than 100 unique members of Congress have co-sponsored such bills during the previous two sessions of Congress. But the bills have effectively been stopped by congressional leaders of both parties: no bill limiting lawmakers’ stock trading has been granted a committee vote in the House, and no bill on the topic has been voted on by the full Senate. Congressional leaders like Chuck Schumer who are now voicing concerns over “insider trading” are the ones who have been sitting on bills that could have constrained insiders from making moves for profit.

On Wednesday at 9:37 am ET, President Trump posted on his social media platform that it was a "great time to buy," and a few hours later announced a 90-day pause on most of his “reciprocal” tariffs, except for his large tariffs on China and a universal 10% import tariff—sending stock markets rocketing upward in just minutes.

After the announcement, Sen. Chris Murphy (D-Conn.) posted on X, “An insider trading scandal is brewing.” Chatter ran through Congress, according to news reports, about the chances of Trump’s inner circle getting a timely tip.

Video posted on social media of a meeting in the Oval Office later that day showed Trump bragging about the day’s stock market gains with billionaire Charles Schwab, a large Republican campaign donor. “He made $2.5 billion today, and he made $900 million,” Trump said, pointing at a pair of his guests.

On Friday, Sen. Elizabeth Warren (D-Mass.) led a letter, joined by five Democratic senators, addressed to newly-confirmed Securities and Exchange Commission Chair Paul Atkins. The senators, including Minority Leader Schumer, asked for an investigation into potential securities law violations around Trump’s tariffs announcements.

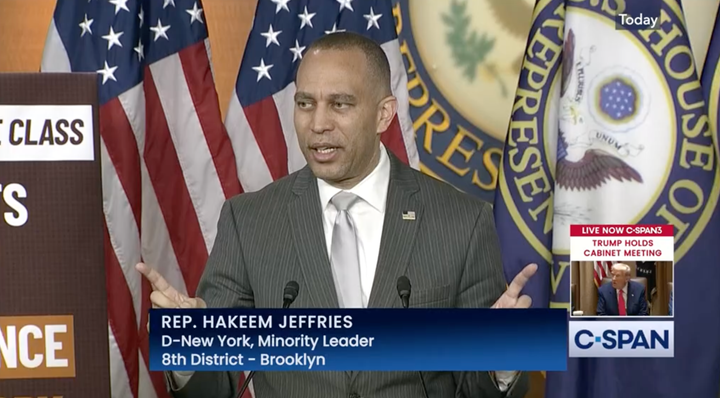

More Democratic leaders in Congress picked up on the talking point, with House Minority Leader Hakeem Jeffries calling for scrutiny of “possible stock manipulation unfolding before the American people—including what, if any, advance knowledge members of the House Republican Conference had of Trump’s decision to pause the reckless tariffs he put in place.”

Rep. Alexandria Ocasio-Cortez (D-N.Y.) was quick to highlight the potential for insider trading, posting on Wednesday night about a suspicious spike in NASDAQ trading volume before the announcement, and writing, “It’s time to ban insider trading in Congress.” At a Los Angeles event over the weekend attended by tens of thousands of people, AOC said, “I don't care what party you are, Democrat or Republican, I don't care what position one holds—members of Congress and elected officials holding and trading individual stock is wrong. It must end and we must ban it.”

Certain executive branch officials are required to file transaction reports of any stock trades over $1,000 within 45 days, but that requirement only applies to public filers, who make up a small set of high-level officials. Many more non-public filers have to file annual disclosures, but any trades made last week would not be reported on those disclosures until May 15 of next year at the earliest. Also, some executive branch advisors who are classified as special government employees, like Elon Musk, are able to evade public financial disclosure requirements.

The federal agency that typically takes the lead in investigating insider trading cases, the SEC, has reportedly seen its staff reduced by around 10% due to buyout offers, including employees in enforcement. The recent Senate Democrat letter pointed to reduced enforcement at the agency. Insider trading cases are often prosecuted with the Justice Department, now led by Attorney General Pam Bondi, who is widely described as a Trump loyalist.

The only bill limiting stock trading that has seen any movement was a modified version of a bill sponsored by Sen. Jeff Merkley (D-Ore.) called the ETHICS Act, which finally last year was advanced by the Senate Committee on Homeland Security and Governmental Affairs, though it did not receive a full Senate vote.

One bill that sought to crack down on conflicted stock trading in government was the Anti-Corruption and Public Integrity Act, introduced by Warren in August 2018. The first Trump administration broke precedent by not divesting the president’s assets, spurring interest in anti-corruption measures. Among its many ethics reforms, Warren’s bill would have banned “individual stock ownership by Members of Congress, Cabinet Secretaries, senior congressional staff, federal judges, White House staff and other senior agency officials while in office,” according to an official summary. The summary goes on to say that the bill would “prohibit all government officials from holding or trading stock where its value might be influenced by their agency, department, or actions.”