Following reports from Sludge on the members of Congress who own stocks in defense contractors and fossil fuel companies, Congressional Progressive Caucus member Rep. Ro Khanna (D-Calif.) announced that his spouse, Ritu Khanna, would divest from assets in those industries.

Khanna announced the defense stock divestments in December 2020 and the fossil fuel stock divestments in October 2021, making him one of the only members of Congress whose household has committed to steering clear of industries they find problematic.

But months later, Ritu Khanna’s trust continue to buy and sell stocks in both the fossil fuels and defense industries.

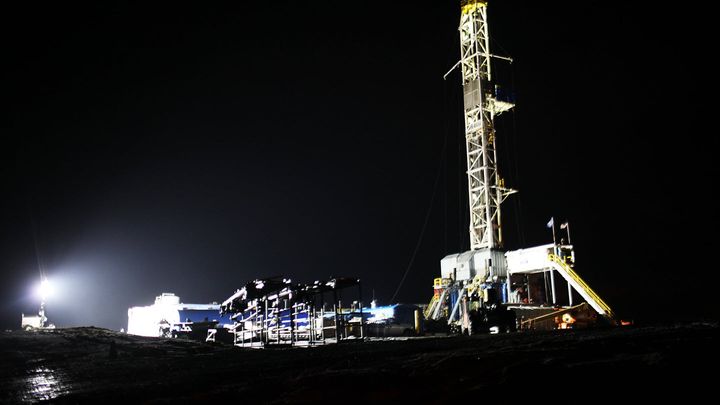

According to Khanna’s most recent transaction report, covering the month of January, Ritu bought and sold up to $100,000 worth of stock in fossil fuel companies Phillips 66 and Coterra, formerly known as Cabot Oil and Gas. She also bought up to $50,000 of stock in Atmos Energy, one of the largest natural gas distributors in the country, and the same amount in energy company Xcel Energy, which currently operates 13 coal power plants according to its most recent annual report.

Also in January, Ritu Khanna purchased up to $50,000 worth of shares in Department of Defense contractor General Dynamics and reported making a partial sale of her shares in the company later in the month.

In a comment provided after publication, Rep. Khanna told Sludge: “My wife’s financial advisor sold the stocks the very same month they were purchased by the independent money managers. So they are making every good faith effort to divest from defense and oil and gas industry and have done so with 98 percent of their assets.”

Last August, Sludge reported that Ritu Khanna’s trust bought stock in July 2021 in nuclear weapons developer Honeywell, and retained holdings in Defense contractor Leidos long after telling anti-war group Code Pink that she no longer has assets in weapons companies. Drone company Dynetics, a fully owned subsidiary of Leidos, designs and produces warheads for the U.S. military.