Joe Kennedy, a Top Recipient of Hedge Fund Cash, Declined to Back Tax Fairness Act

Unlike his Democratic Senate primary opponent Sen. Ed Markey, Rep. Joe Kennedy has declined in multiple sessions to co-sponsor legislation to end the carried interest tax loophole enjoyed by hedge fund and private equity managers.

UPDATE: Five days after this article was published, Kennedy signed on as a co-sponsor to the Carried Interest Fairness Act.

In his campaign to unseat progressive stalwart Sen. Ed Markey (D-Mass.), Rep. Joe Kennedy (D-Mass.), the grandson of former attorney general Robert F. Kennedy, has painted himself as a reformer who will work for the people who have been disenfranchised by the political system. “Systemic reform begins with recalibrating our entire economy to put power with workers, families, and communities–not corporate interests,” Kennedy’s “economic justice” issue page reads. Yet when it comes to reining in the private equity and hedge fund raiders who extract value from the economy, often at the expense of workers and economic stability, Kennedy has not taken any action while in Congress.

The private equity and hedge fund industries have benefited for decades from a key tax code advantage known as the carried interest loophole. General partners at the firms—whether gobbling up small businesses or speculating on derivatives—don’t invest with their own money; the money comes from private sources like pension funds, endowments, and wealthy accredited investors. But loopholes in the tax code have allowed these fund managers to treat the money they earn from their investors’ funds as capital gains rather than as ordinary income, meaning their tax liability is often at the long-term capital gains rate of 15% or 20% rather than the standard personal income rate of up to 37%. This loophole increases income inequality by helping investment fund managers become extremely wealthy while depriving the government of billions in lost tax revenue. It’s a big reason why these industries have become as massive and influential as they are today.

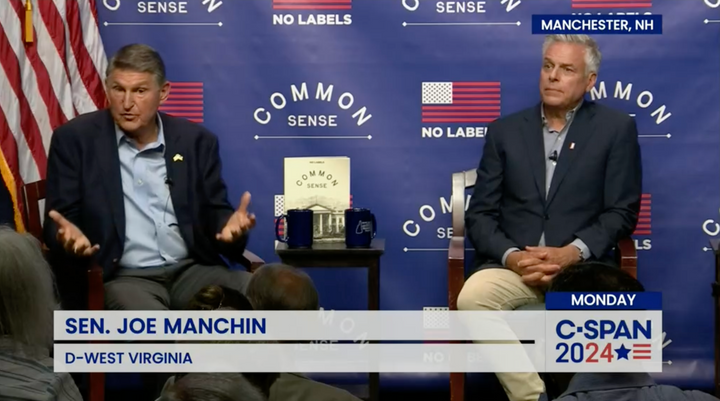

Beginning in 2015, Markey has co-sponsored the Carried Interest Fairness Act, a bill that seeks to modify tax laws so that carried interest earned by hedge fund and private equity fund managers from investors’ assets—typically 20% of profits—is taxed as ordinary wage income. The capital gains rates would still be available under the bill for limited partners who invest their own money through private funds. Markey was one of 13 senators to sign onto the bill when it was first introduced in 2015, joining a coalition that included Sen. Bernie Sanders (I-Vt.) as well as conservative Democratic Sen. Joe Manchin (W.V.). Markey did not co-sponsor the bill in the next legislative session, but he signed onto the bill again in the current session of Congress.

While Kennedy has followed Markey’s lead on several high-profile progressive bills, for example co-sponsoring the House version of Markey’s Green New Deal legislation, on the more obscure issue of carried interest taxation he has not taken a progressive stance. Kennedy, who has been a House member since 2013, has never co-sponsored the bill, which has attracted from 35 to 58 House Democratic co-sponsors in the various sessions it has been introduced. House co-sponsors of the measure tend to be on the progressive side of the party and in the current session include Rep. Alexandria Ocasio-Cortez (D-N.Y.) and Congressional Progressive Caucus Co-Chair Rep. Mark Pocan (D-Wis.).

A spokesperson for the Kennedy campaign, Emily Kaufman, told Sludge that Kennedy “has been supportive of ending the carried interest loophole since he first got elected,” adding that he listed the policy on his first campaign website in 2012 and that it was part of his first stump speech on taxes. Kaufman said that Kennedy was “not aware” of the Carried Interest Fairness Act, which was first introduced in the House in 2012 and reintroduced in 2015, 2017 and 2019.

Despite any early statements in favor of closing the loophole, once he was in Congress Kennedy got heavy financial backing from industries that lobby to keep the loophole intact. According to campaign finance data compiled by the Center for Responsive Politics, Kennedy is is the third-largest House recipient of hedge fund industry cash in the current election cycle, with $99,840 from the industry (not including any additional contributions that may be disclosed in his just-filed Q2 report), and the fifth-largest House recipient from the private equity and investment industry, with at least $190,433.

Markey has also received funding from the industries, but his totals are lower. Over the same period, Markey received $9,847 from the hedge fund industry and $141,896 from private equity.

Some of the most powerful and political influential figures in the hedge fund industry have donated to Kennedy and not to Markey. Former GOP megadonor Seth Klarman, CEO and portfolio manager of Baupost Group, a Boston-based hedge fund whose investments include liquid natural gas companies and distressed Puerto Rican debt, has given Kennedy $5,600 this cycle, according to Sludge’s review of Federal Election Commission records. Klarman’s wife, Beth, also donated $2,800. Another hedge-fund billionaire backing Kennedy is Donald Sussman, the founder and chief investment officer of hedge fund Paloma Partners, who chipped in $5,600.

Other Kennedy donors have lobbied for the industry to keep the carried interest loophole intact. Cypress Group lobbyist Langston Emerson, who has lobbied on carried interest taxation for the Managed Funds Association, a hedge fund trade group, and the American Investment Council, which is the organization with the most lobbying reports filed that mention the Democratic-sponsored Carried Interest Fairness Act (H.R.1735), gave Kennedy $1,500 in February. In a statement posted after the Carried Interest Fairness Act of 2019 was introduced, the American Investment Council called the bill a “discriminatory tax increase” and said it was “a direct assault” on the capital gains treatment investment managers enjoy on profits earned from investors’ funds. Other current lobbyists for the American Investment Council that have given to Kennedy this cycle include Duberstein Group’s Kate Keating ($2,800) and Subject Matter’s Stacy Alexander ($3,300).

Managed Funds Associations’ executive vice president Anthony Coley gave Kennedy $500, and Capitol Legislative Strategies lobbyist Charles Mellody, who represents Renaissance Technology on ”tax issues affecting hedge funds,” also gave $500. In May 2019, before pledging to reject corporate PAC money, Kennedy took $2,500 from the National Venture Capital Association, an investment industry trade group that lobbies Congress on “taxation of carried interest.”

Former BlackRock executive Morris Pearl, who is now chair of Patriotic Millionaires, a group of wealthy individuals that advocates for policies to address income equality, told Sludge that the process of fundraising from business leaders can influence politicians.

“One of the problems with our campaign finance system is that our elected officials have to spend way too much of their time soliciting donations from the rich, and they become very expert at those problems,” Pearl said. “I am sure that after getting to know some of his major donors that Representative Kennedy really has developed a deep understanding of the problems of billionaire hedge fund managers, and really believes that they need a special tax break in order to, I don’t know, avoid the collapse of Western civilization. But he’d be wrong to believe that.

“The existence of the carried interest loophole is absolutely ridiculous, and it’s sad to see that Rep. Kennedy clearly doesn’t feel like getting rid of it is part of his job representing his constituents.”

The hedge funds spent more than $6 million on federal lobbying last year, according to the Center for Responsive Politics, led by $3.2 million in spending from the Managed Funds Association. The private equity industry spent more than $14 million on lobbying last year. In addition to their direct lobbying, hedge fund and private equity companies and executives fund think tanks like the Manhattan Institute that advocate for greater privatization of education and transportation.

Kennedy has a significant portion of his estimated net worth of $46.5 million invested in private equity funds. According to his most recent annual financial disclosure, Kennedy’s inherited family trusts have as much as $8.9 million invested in multiple Brandy Wine Private Equity Partners funds, as well as up to $1 million in Brandytrust Global Partners LP, a hedge fund operated by Brandywine Managers, and smaller investments in other Brandywine funds.

Correction: This article originally stated that the Carried Interest Fairness Act had been introduced in ever session of Congress since 2012. While it was first introduced in 2012, it was not introduced in the 2013-14 session but was again introduced in each subsequent session beginning in 2015.

Read more from Sludge:

Kennedy Fails to Return Fossil Fuel Lobbyist Donations

Senators Who Will Impact Green New Deal Own Stock in Fossil Fuel Companies

Richard Neal Is #1 in Corporate PAC Donations

‘No Corporate PAC Money’ Dems Keep Taking Corporate PAC Money

Comments ()