EXPOSED: Reps Pass Bills That Benefit Their Own Private Companies

Nearly 100 House representatives hold positions at private companies. There's nothing stopping them from using their legislative power to pad their bottom lines.

This post was authored by independent journalist Justin Glawe.

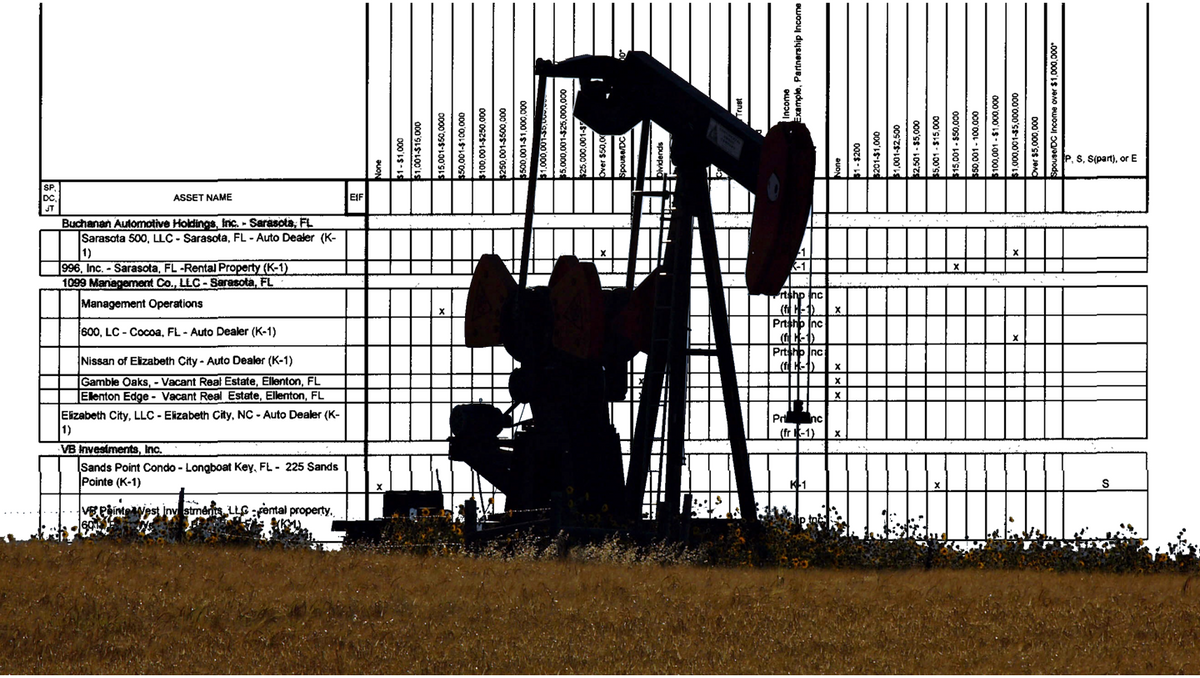

When Florida Republican Vern Buchanan introduced a bill in 2017 to lower federal income taxes on limited-liability corporations, he called it the Main Street Fairness Act, saying that small businesses shouldn’t have to “pay a higher tax rate than large corporations.” What he didn’t say is that the bill would save him as much as $7.5 million in taxes on income from his own private companies, most of them LLCs.

Buchanan is the president, director, member, or partner of 29 private companies, according to disclosures reviewed by Sludge. He earned more than $3.6 million from these businesses in 2018—and maybe as much as $20 million. But his day job isn’t any of those positions: it’s United States representative.

Buchanan is far from the only member of Congress to have dual roles in public office and private business. Currently, 92 House members hold positions with 326 private companies, Sludge found by reviewing the most recent annual financial disclosures filed by House representatives. (More than a dozen new members elected in 2018 were associated with more than a dozen companies, although their relationships with those companies remains unclear because they have not yet filed financial disclosures that cover 2019.)

As millions of American struggle to pay bills and put food on the table after months of a shutdown put in place to slow the spread of the coronavirus, the economic gap between citizens and their elected representatives once again came into sharp focus recently. That’s thanks to scores of stock trades made by Senators Richard Burr (R-N.C.) and Kelly Loeffler (R-Ga.) who, after being briefed in January about the threat of the virus, went on a selling spree, dumping stocks in companies that would be hit hard by the economic shutdown.

Burr and Loeffler’s questionable stock trades—for which prosecutors are investigating in the case of Burr, but have dropped the case against Loeffler—present a level of transparency that the companies tied to members of Congress do not. Where Burr, Loeffler and all members of Congress must report individual stock transactions and disclose a broad outline of their financial situations, the private companies with which members are associated are much more opaque. Many members don’t report at all what the companies do or how they make money, presenting an ethical minefield of conflicts of interests not yet fully examined by ethics officials, lawmakers, and good government groups.

It’s not illegal or a blatant violation of House ethics rules for representatives to hold positions in private companies, although government ethics experts told Sludge that these representatives could easily violate House rules on outside income without anyone knowing. House rules prohibit members from earning more than 15 percent of their congressional salaries—$174,000 a year—from sources of “outside earned income.” Key to that prohibition is the word “earned,” said Craig Holman of Public Citizen, a Washington good government group.

“Given the magnitude of the profits, pretty much any amount of personal services […] would probably qualify as earned income. But [Buchanan’s] financial disclosure statement doesn’t tell us whether he is providing any personal services,” Holman said. “It is conceivable that all this is just a passive form of income from investments and holdings, though if that were the case, it would seem Buchanan would just throw all these investments into a blind trust to be managed by someone else.”

Conflicts of interest like Buchanan’s exist across the House, with a quarter of representatives holding positions at private companies. While many of Buchanan’s companies are related to real estate holdings and car dealerships, the companies associated with the other 91 members of Congress cover a wide range of industries, including agriculture, mining, finance, pharmaceuticals, and media, all of which are regulated by Congress and directly affected by its laws.

All of this presents an astounding potential for conflicts of interest with representatives’ duties as public officials, and in fact it is not uncommon for House members to work on advancing legislation that benefitting their businesses.

Rep. Mike Conaway (R-Texas) is a staunch energy and oil man, who has blocked attempts to reduce carbon emissions while pushing to expand drilling. Conaway is also the vice president and president of three oil and gas exploration firms located in Midland, Texas, in the heart of the massive Permian Basin, which in 2019 became the top oil producer in the world. In April, Conaway sponsored legislation that would use $3 billion in taxpayer dollars to purchase crude oil from companies like his own. That same month, Conaway pressed the Interior Department to eliminate royalties for oil companies working on federal land—a boon to the industry that was made official policy in May as part of sprawling efforts by the Trump administration and Republicans in congress to boost the oil industry and punish renewable energy.

Rep. Mac Thornberry (R-Texas), member of two cattle companies, successfully added an amendment to the 2018 Farm Bill to provide more Department of Agriculture beef graders in cattle country, something that cattleman’s associations have been calling for for years.

Rep. Bill Huizenga (R-Mich.) holds the top four positions at a family-run gravel and mining company, of which he owns 50 percent and made as much as $1 million in income from in 2018, according to his financial disclosure.

Like Buchanan, Conaway, and Thornberry, Huizenga has also inserted his personal business interests into legislation he has worked on. In 2017, Huizenga authored a bill to allow resource extraction companies like his own to avoid disclosing payments made to foreign governments, as required by the Dodd-Frank Wall Street Reform and Consumer Protection Act. The bill later became law. The offices of Huizenga, Buchanan, Conaway and Thornberry did not respond to detailed questions about their companies and related legislation.

Democrats aren’t completely immune from the potential self-dealing either, although a Sludge analysis of their companies and sponsored legislation found no immediate and glaring conflicts of interest. If they’re guilty of anything, it’s that their companies—95 in all—aren’t easy to track down. The closest any Democratic member comes to having a conflict of interest is Maryland’s David Trone, whose alcoholic beverage retailer is facing off against the federal government in the Supreme Court in an attempt to force states to allow him to expand what some consider to already be his company’s monopoly.

Noah Bookbinder, executive director of the Washington ethics watchdog Citizens for Ethics and Responsibility, said more restrictions on members of Congress being invested in, let alone directly involved with, private companies is in order.

“There are sacrifices that people make to go into public service,” Bookbinder said. “No one is saying they should give up their money, but it is a very reasonable thing to say you cannot be directly invested in individual companies that could be affected by your work as a lawmaker.”

A stalled effort at reform

The current push by Democrats to tighten ethics rules is a direct result of the actions of former Rep. Chris Collins, a Republican who resigned his seat in fall 2019 ahead of pleading guilty to insider trading charges. Collins sat on the boards of more than a dozen private companies, including an Australian biotech firm whose stock Collins allegedly told his son (from the White House lawn) to dump when he got inside information that the company failed a drug trial.

After taking back the House in 2018, Democrats made ethics one of the planks of their sweeping government reform bill, H.R. 1. Members of Congress are already barred from serving on the boards of publicly traded companies, but to avoid more situations like that of Collins, Democrats went one step further with their bill, proposing that members “may not serve on the board of a for-profit entity.”

That may sound simple, but it is not. First, many of the 326 companies that House members were associated with as of this writing don’t have boards, so the H.R. 1 rule wouldn’t apply to them. (Most members of Congress have yet to file financial disclosures for 2019, which are due on May 15, instead filing extensions that allow them to file at a later date. This is standard practice, especially for wealthy members of Congress like Buchanan.) Second, even if members’ companies look like for-profit entities, a lack of actual profits could preclude them from the prohibition. Finally, if a member’s company fit both criteria of the prohibition, they could simply dissolve the board and make the company a single-member LLC, said Holman of Public Citizen.

“The H.R. 1 would not apply to most LLCs, and those [members] that it would apply to, I would expect to evade the rule,” Holman said.

Of the 326 companies, more than 150 are LLCs.

Still, House Democrats insist that H.R. 1 closes the “loophole” that Collins exploited—serving on the board of a private company and not a public one.

“Among other reforms, this bill will close a loophole that allowed some members to hide financial conflicts of interest that are otherwise prohibited,” said Rep. Carolyn Maloney (D-N.Y.) in a statement.

Maloney is heavily involved in the bill’s particulars, negotiating with both ethics advocates and Republicans on H.R. 1’s provision regarding members’ involvement in private companies, Andrew Lowenthal, Maloney’s chief of staff, told Sludge. She is also associated with four private companies, which Lowenthal said do not make a profit and exist as shells for land owned by the Maloney family and as a vehicle to collect rent on a townhome the Congresswoman owns in New York.

“But, H.R. 1 is not a fix-all,” Maloney said. “Every constituent deserves to know and understand what, if any, financial conflicts may affect policy decisions by their member of Congress.”

Coming to that understanding is difficult and time-consuming, though. The majority of the companies members of the House are affiliated with are opaque LLCs. Their articles of incorporation aren’t always available on any state government website, and for many there is no information available on the internet about how they make money. All that each member is required to do is tell us the names of the companies where they hold positions and how much money they made from them—roughly, because members of Congress are only required to report income and the values of assets within a range.

For Buchanan alone, his companies include Jamatt Financial, Inc. (at least $100,001 in 2018 income), 996 Inc. (at least $15,001) and 600, LLC (at least $1 million), to name a few. The latter two are registered to Buchanan’s son, who runs the family’s car dealership. Many of the other companies appear to mostly deal with real estate. Regarding the other two dozen companies, for which public records searches do not disclose descriptions of business operations, Buchanan’s office did not respond to Sludge’s request for more information.

A transparency nightmare

The conflicts of interest that exist every day in Congress are easy to find if you know where to look. Members must release financial disclosure statements in which they’re required to report positions held outside Congress, whether at a university, charity or their own private company. While it’s possible to look up one representative’s financial disclosure, find their private company, search a state website to find its articles of incorporation and cross-check it with bills they’ve introduced or sponsored to expose potential corruption, it’s not so easy to do that for all members of Congress.

It took this reporter six months to compile a database of two year’s worth of information about members of the House and their companies, gleaned from annual financial disclosures. That painstaking work is not being done by anyone in a systematic and sustained fashion, which is how a lawmaker like Buchanan can write a bill giving himself a massive tax break without anyone noticing for years.

This type of watchdog reporting used to occur more frequently, albeit in piecemeal fashion. Back when local newspaper reporters actually had time to comb through their local representative’s financial disclosures, deeds like Buchanan’s would wind up on the front page. With local newsrooms being decimated, those stories aren’t being printed.

There is some hope that ethics hawks among House members and perhaps the Ethics Committee itself will hold politicians accountable, but as an election year looms, that prospect is likely to be as partisan as ever, if it even occurs at all. The true check on these bad actors are voters, who might read a story like this, walk into a voting booth in Buchanan’s hometown of Sarasota, and decide he’s got to go.

Related:

The Members of Congress Who Profit From War

As Markets Crashed, DeVos Sold Shares in Secretive Cayman Island Fund

Dems Overseeing Finance Industry Take Money from Group Supporting Racist Auto Lending

STOCK TICKER: Wife of Rep on Health Subcommittee Is Trading Health Stocks

Comments ()