Ethics Committee Republicans Defy Committee's Own Financial Disclosure Recommendations

Three out of the five GOP members of the House Ethics Committee file paper disclosures, even as the committee “strongly urges” members to file electronically.

“The Committee strongly recommends using the electronic filing system to complete Financial Disclosure Statements and Periodic Transaction Reports,” reads the House Ethics Committee’s online guidelines for financial disclosure reporting. “Doing so will reduce errors and greatly simplify future filing.”

Despite their committee’s own recommendations, three out of the five Republican members on the committee, including Ranking Member Rep. Kenny Marchant (R-Texas), file their financial disclosures on paper, making them more difficult for the public to review. All five Democrats on the Committee file electronically.

Representatives and senators are required to file annual financial disclosures, which reveal the personal investments, financial transactions, liabilities, and outside positions of members and their spouses. They also need to file periodic transaction reports (PTRs) within 45 days of certain purchases and sales, such as buying or selling corporate stock.

These reports are essential for identifying potential conflicts of interest of elected officials. In recent years, watchdogs and journalists used the disclosures to identify multiple House members with financial improprieties. Most notable was former New York Rep. Chris Collins, who resigned in late September just before pleading guilty to insider trading. Without financial disclosures, Collins would still be in office, and the public would not be aware of politicians such as Collins who use their insider knowledge of industries and regulations for personal financial gain.

Paper reports are enormously cumbersome for the media and the public. Handwritten reports are often difficult, or impossible, to decipher, and they’re not machine-readable. In most cases, software that performs optical character recognition (OCR) is unable to process these reports, making it impossible to incorporate the financial data into a database without inputting it manually. (Sludge created a database of all machine-readable financial disclosure data for members of Congress and has manually added a portion of the data from handwritten reports.)

The Center for Responsive Politics (CRP), which tracked personal financial disclosures for years, wrote that “non-electronic filings are an unacceptable artifact of the past in 2013. Filing on paper slows the disclosure of information that helps the American public keep tabs on those representing them in government.”

Daniel Schuman, policy director of good-government nonprofit Demand Progress, told Sludge that he “absolutely” has problems with paper disclosures. “When working with paper reports, the first thing anyone does is to go in and digitize them,” he said. “This is really expensive and takes forever.”

“To figure out if something is usual or unusual, you have to look at other disclosures,” said Schuman. When the documents are trickier to access, it makes these comparisons more difficult.

“All of this information should be disclosed in real time online in [digital] formats,” he said.

In 2012, Congress passed the STOCK Act, which, among other things, required lawmaker to file their financial disclosures electronically. Then, in April 2013, Congress repealed the e-file requirement and another major improvement to financial disclosure: the formation of a searchable and sortable online database of members’ finances. President Obama signed the repeal bill days later. CRP called the reversal “toothless,” saying in an action alert that “the ability of watchdog groups to verify that Congress is following its own rules is severely limited because these records could still be filed on paper—an unacceptably outdated practice that limits the public’s access.”

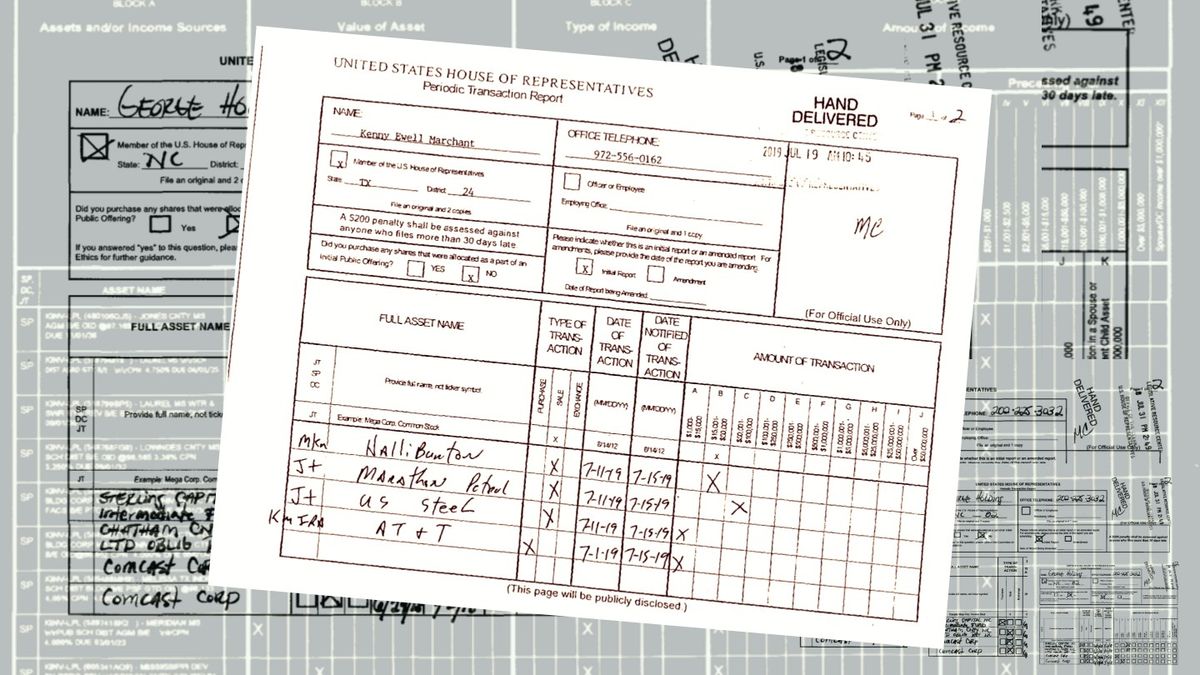

Marchant files his annual disclosures and PTRs on paper. His 2018 report, which includes printed text on the dense paper format, does not itemize his individual investments; instead, he includes copies of all of his monthly statements from all managed accounts and trusts. To determine how much money Marchant has invested in a certain stock, you need to scroll through the 601-page document and tally up all investments in that stock from numerous different investment accounts. It is extremely time-consuming.

Marchant’s PTRs are handwritten.

Committee member Rep. Michael Guest (R-Miss.) also prints text onto the paper disclosure form. The font is very small and difficult to read.

Rep. George Holding (R-N.C.), also on the Ethics Committee, filed his 2018 annual disclosure electronically but continues to turn in handwritten PTRs, like the one below.

One of the most egregious paper filings is Rep. Sheila Jackson Lee’s (D-Texas) 2018 annual disclosure. (Lee is not a member of the Ethics Committee.) The first page of the assets section is impossible to decipher; the writer appears to have used a thick, permanent marker to fill in the tiny boxes. What’s more, every other column that indicates the dollar range of the investments and the annual profits is blacked out, meaning that the reader can only view investments that happen to fall within the ranges not obscured.

Sludge repeatedly contacted Jackson Lee’s office to ask for a legible copy and did not receive a response.

Members and staff of the House Ethics Committee only comment on committee matters via public statements released on the committee’s website. Requests for comment from Guest, Holding, Marchant, Committee Chair Ted Deutsch (D-Fla.), and committee staff were either declined or ignored.

Comments ()