Op-Ed: Ditch the Unemployment Rate

Does President Trump really have the benefit of a strong economy heading into the 2020 election year?

The 2020 Democratic presidential race is ramping up amid widely positive media coverage of jobs and the U.S. economy. Washington Post readers recently encountered the conventional wisdom that Trump’s reelection campaign has the benefit of managing a strong economy “effectively.”

Two days later, Fox News predictably continued serving as the leading cheerleaders for the President. Under the chyron “Trump touts America’s soaring economy,” a host effused, “Thank God we live in the kind of country where you can work multiple jobs.”

Also today, the Federal Reserve begins a two-day meeting, with the universal expectation it will continue juicing the U.S. economy by further cutting interest rates. The main question is by how much.

On Friday, the U.S. economy’s second quarter numbers came in at an underwhelming 2.1% GDP growth rate, a decline from a 3.1% increase in the first quarter. It was one full percentage point lower than President Trump’s prediction, and it arrived after two years of enormous fiscal stimulus from the Fed and the Republican tax cuts of December 2017.

But the perception of a strong economy is not restricted to Fox News, as can be seen just recently on MSNBC, where a segment highlighted a poll finding that a majority of voters think the economy is “good.” CNN viewers back in March saw a piece that 7 in 10 Americans agree: the economic moment is “good,” as Trump-flipped states saw a temporary drop in unemployment.

The likeliest basis for the perception of a good economy is that on July 1, the U.S. marked its longest economic expansion in history, with 121 consecutive months of GDP growth. The run started in 2009, after the Great Recession of 2007 contracted GDP by 4.3% and claimed nearly 9 million jobs (a 7% loss). Yet despite top-line job growth, the overall picture is clear: real wages are stagnant as corporate profits reach record levels, and price increases are eroding small wage gains for the 29% of American adults in the lower class and the 52% in the middle class.

More pointedly, the Democratic presidential race has popularized a key finding of the Federal Reserve’s 2018 survey of U.S. households: almost 40% of Americans would struggle with an unexpected $400 financial emergency. Could any advanced economy claim to be “strong” with such an existential level of financial insecurity? How superficial is the recent U.S. quarterly job growth as the foundation for an ecologically sustainable, widely beneficial modern economy, countering dangerous trends of rising income inequality?

Heading into the 2020 election maelstrom, an important corrective to horse-race political coverage of U.S. economic management is to look for the following in mainstream media:

- Highlight wage growth by income level, not overall GDP growth; and

- Track under-employment figures, such as the Labor Force Participation Rate (LFPR), not brute unemployment numbers

“JOBS, JOBS, JOBS” as a shallow metric

Republican leaders, for their part, point to top-line economic metrics such as quarterly jobs created to justify the Trump administration’s business-interest-dominated policies (and by implication, a continued lack of congressional oversight).

President Trump’s single major legislative delivery in his first two years was the Republican-passed tax cut for the wealthy in December 2017 (the Tax Cuts and Jobs Act, or TCJA), which will reduce federal revenue by at least $1.5 trillion to $2.3 trillion over ten years, with 83% of the benefits going to the top 1% by income (those grossing around half a million annually).

The Congressional Budget Office found in May 2019 that the TCJA, once again, did not in fact increase economic growth or lead to anything near advertised wage growth. Trump will surely fire off those tweets promoting his “JOBS” mantra, but job growth has actually slowed under his presidency compared to President Obama’s performance.

An April 2018 study by the Economic Policy Institute examined the first quarter of economic performance after the Republican tax cuts for the wealthy in December 2017, and found that the change in personal consumption expenditures decreased to 1.5% from 1.9% the previous quarter, an indicator that the Trump tax cut was not working to boost economic growth. Last month, a Fox Business host claimed that repealing Trump’s tax cuts for the rich and corporations “would ruin the economy.”

Ahead of this week’s Federal Reserve meeting, the Washington Post reported: “There is an active debate on Wall Street about whether the Fed will do a modest quarter-point interest rate cut or a more substantial 50 point reduction. Trump is signaling his strong preference for the bigger cut, but Wall Street currently gives that a 41 percent likelihood…”

Ben Herzon, an economist at IHS Market, told NPR in late April, “Last year, growth was boosted by fiscal stimulus. We had pretty big tax cuts, and we had pretty big increases in federal spending. But the contribution to growth from fiscal stimulus is peaking and will begin to wear off this year.” In fact, a July 20 poll of economists by MarketWatch correctly predicted second-quarter growth would come in one point under the 3 percent prediction of the Trump Administration.

One view of economic perception is, of course, through partisan identity: an October 2018 Pew Research survey found that 57% of Republicans now think the U.S. economy is fair, while a rising 84% of Democrats think it unfairly favors powerful interests. Last August, a Pew survey on wage stagnation and job numbers floated, “One theory is that rising benefit costs – particularly employer-provided health insurance—may be constraining employers’ ability or willingness to raise cash wages.”

Last December, the Post summarized where the money went from the TJCA—to stock buybacks: “Apple is leading the way, with nearly $64 billion in buybacks as of Sept. 30, according to Birinyi Associates, followed by Qualcomm ($34 billion), Cisco ($19 billion), Oracle ($18 billion) and Bank of America ($15.8 billion).” Also that month, Vox highlighted the findings of economists that the Republican tax cut did little to increase wages. Millions of dollars from the corporate tax cuts found their way back to supporting Republican politicians before the midterms, through campaign contributions and PAC donations.

Disaggregating Growth

It might seem naive to imagine mainstream media coverage of the economy becoming more highly technical or dispassionately scientific, but at least the empirical economic metrics that get dragged into the political fray can be more accurate for people in the real world.

Progressive economists have long argued for richer, better metrics of the U.S. economic performance to track, ones that would seek to improve on undifferentiated U.S. GDP and the national unemployment rate. United States GDP is currently calculated from personal consumption expenditures, business investment, government spending, and net exports.

A September 2018 piece by New York Times opinion columnist David Leonhardt, “We’re Measuring the Economy All Wrong”, argued for separating out income flows to the rich, middle class, and poor for a more accurate picture of economic prosperity. Leonhardt suggests focusing regulators and the public’s attention on more-meaningful metrics such as the overall share of working-age adults who are actually working, pay at different points on the income distribution, and distribution of net worth.

The Washington Center for Equitable Growth, a research non-profit founded in 2013, has been advancing the topic of disaggregating growth into a new “GDP 2.0”. Earlier this month, social scientist Austin Clemens wrote: “Members of Congress in both chambers have introduced legislation that would require the U.S. Bureau of Economic Analysis to report how growth is distributed among workers at different levels of income. The Measuring Real Income Growth Act is sponsored by Sens. Chuck Schumer (D-NY) and Martin Heinrich (D-NM) in the Senate and Rep. Carolyn Maloney (D-NY) in the House of Representatives”—which has 19 House co-sponsors, as of this writing.

“Since 1980, the richest 10 percent of Americans have captured more than half of all growth in the economy,” the organization wrote in a July 1 post. “Meanwhile, working-class Americans with below-median incomes have received just 10 percent of all growth. Americans in this group are keeping up with inflation but have relatively stagnant incomes; they are essentially treading water.”

A July 3 report by the Center for American Progress concluded: “Top-line job numbers do not indicate whether workers are paid a wage that allows them to move out of poverty, and policymakers who focus on jobs instead of wages, income, and wealth ignore how most workers and families experience the economy.” A Pew study in August 2018 noted that wage stagnation was a primary driver of city-level campaigns to raise the minimum wage to $15 an hour.

More recently, Vox policy reporter Alexia Fernández Campbell looked at the June 2019 jobs report and noted, “millions of Americans are working part-time jobs when they would rather get full-time gigs, or at least work more hours. The number of people in that group has been mostly shrinking but still added up to 4.3 million workers in May.” That’s getting closer to the number that would be better broadcast by talking heads, rather than the national unemployment rate. In fact, just last month, after fizzy coverage of first quarter job numbers, CNBC found the trend of falling unemployment in states that Trump won was reversing.

“Thick” Under-Employment vs. “Thin” Unemployment

One key is the difference between the unemployment rate and the under-employment rate—the latter, as calculated by progressive think tanks such as the Economic Policy Institute (EPI). The un-employment rate would be roughly double if it were truly capturing the full under-employment rate, everyone searching for a job who’s given up. For example, a 2017 report by EPI identified 1.5 million “missing workers” not reflected in the official unemployment rate.

Towards a better picture of job seekers than the national unemployment rate, Quartz economics writer Dan Kopf summarized in January 2017:

“As measured by the [Bureau of Labor Statistics], the unemployment rate is defined as the percentage of unemployed people who are currently in the labor force. In order to be in the labor force, a person either must have a job or have looked for work in the last four weeks. A person only needed one hour in the prior week to be considered employed. This leaves out a ton of relevant people. According to the November 2016 data, over 5.5 million Americans said they want a job, but don’t have one, and are not considered a part of the labor force. If these people were included in the unemployment rate, it would jump to 8.2%.”

The national unemployment figure gets a fair amount of attention in political news for currently coming in at “under four percent”— immediately-findable online to be 3.8% as of March 2019—so where does a casual news consumer find the under-employment rate?

A simple online query for the current under-employment rate confidently returns a number that turns out to be from 2016. The Bureau of Labor Statistics’ (BLS) dismayingly old-fashioned website spits out a last tier, called U-6, that reports the figure at 7.2% in June 2019. For people with regional interests, a simple chart is also available from BLS breaking down the under-employment rate by state. Similarly, the Quartz article above mentions a “nonemployment rate” created in 2014 by a group of reformer economists, which can be seen on the site of the Richmond Fed, and stands at 7.6% in May—but this sophisticated metric hardly receives the same exposure on national cable news as brute GDP.

A Google News search for “unemployment rate” from U.S. publications returns scores of headlines with that phrase over the past week, but precisely zero headlines with the phrase “underemployment rate” in that time frame. It seems the unmet need is for a one-stop web dashboard—displayed, say, on the Pew topic page for National Economy—with an at-a-glance under-employment chart that can be widely understood by political news audiences. Or, put a gigantic dashboard of EPI’s Nominal Wage Tracker on Capitol Hill, and design it into free and libre graphics for news outlets to re-use instead of the unemployment rate.

Similarly, as part of its Broken Capitalism series, The Guardian ran a column from Heather Boushey, E.D. of the Center for Equitable Growth, on the need for better metrics for measuring inequality: “A clearer picture of the disconnect between overall growth and worker welfare will force a deeper examination of what’s gone wrong with the capitalist engine. At root, the answer is: power. The gradual diminution of worker-friendly labor market institutions combined with the rise of employer market power have pushed the power pendulum away from workers.”

To broadly consider more starting points for evaluating the economic moment: the U.S. accumulated by far the highest national net wealth of any country (almost twice as much as second-place China), and has a nominal GDP of $20.5 trillion, compared to China’s $13.4 trillion—roughly as much as the next six nations put together. Yet the U.S. comes in around fourth or worse in Gross National Income per capita, with less than a quarter of China’s population, and stands back at 29th of 35 OECD countries in income inequality.

How can a political news consumer come to better understand and communicate the opportunity cost of the Republican tax cuts for the wealthy and corporations? In January, Josh Bivens of EPI highlighted “employment multipliers”—a stark difference from the record share buybacks ushered in by the Tax Cuts and Jobs Act (TJCA). And the New York-based Institute for New Economic Thinking, a nonprofit founded by economists in the wake of the 2009 financial crisis, offers dozens of fresh reports on labor, including a recent set of recommendations on preserving worker protections in the future of work. The London-based Legatum Institute calculates a U.S. Prosperity Index for all 50 states, but its studies have not exactly been showcased recently on U.S. cable news or asked about in the Democratic presidential debates.

For reality-based economic observers, the task is to build awareness of better economic metrics like GDP 2.0 and under-employment among casual news viewers, especially on Fox and CNN. Within the trusted networks of friends and family, news readers can circulate the perhaps-charmingly outdated official BLS website, with its under-employment calculation at 7.2 percent (closer to double the unemployment rate) and the official labor force participation rate.

Reporters and editors can do more to balance shallow public perception at the window dressing of top-line economic numbers with the deeper reality of the U.S. as the most-unequal rich country, a status quo with ample practical policy fixes.

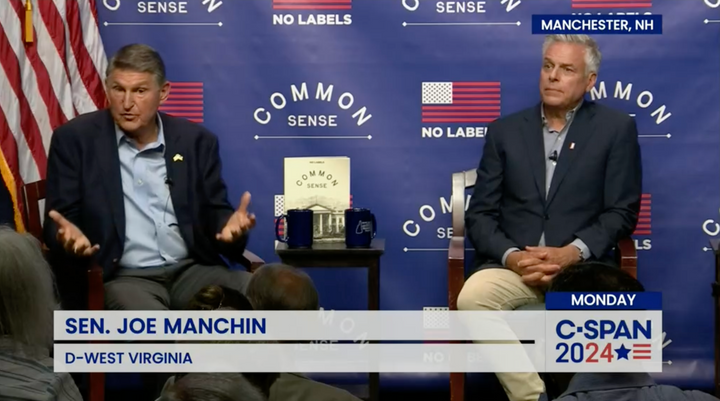

Last, governors and state legislators may offer more-responsive question targets about the real labor participation rate than Beltway-insulated members of Congress, who over the past few years have increasingly ducked out on district town halls—though trends are encouraging this year for in-person question time. Maybe some of those constituent questions over this summer’s congressional recess can be about the under-employment rate in the real world, as opposed to the headlines.

Comments ()