To Quash Green New Deal, Big Oil Pushes a Corporate-Friendly Carbon Tax

Backed by top global corporate powerhouses, the plan is driven by an industry-friendly logic firmly within the bounds of the neoliberal imagination.

This article was first published at Eyes on the Ties, a news site by LittleSis.org.

With intensifying demands for bold climate action, the fossil fuel industry and its top allies are lining up behind a corporate-funded, market-centered carbon tax proposal, in an effort to stem the rising momentum around ideas like the Green New Deal and growing shareholder and investor concerns about the climate crisis.

Oil and gas powerhouses BP and Shell recently announced that they were each contributing $1 million over the next two years to lobbying efforts for the Baker-Schultz Plan, which proposes an initial tax of $40-per-ton on carbon emissions.

The plan, named after ex-Reagan officials James A. Baker III and George P. Shultz, is being promoted by the Climate Leadership Council and its lobbying arm, Americans for Carbon Dividends. The Climate Leadership Council is made up of a host of founding members whose primary business is in the fossil fuel industry, such as BP, Exxon, and ConocoPhillips.

According to the website of Americans for Carbon Dividends, the Baker-Shultz Plan is “based on the conservative principles of free markets.”

Backed by top global corporate powerhouses, the plan is driven by an industry-friendly logic firmly within the bounds of the neoliberal imagination. For example, under the plan, revenue generated from the carbon tax would be returned back to “taxpayers,” rather than used by the government to oversee an accelerated transition to a system of renewable energy.

In putting millions behind the Baker-Schultz Plan, BP and Shell are joining Exxon and ConocoPhillips, who have pledged $1 million and $2 million respectively over the next two years, in backing the effort.

The fossil fuel industry’s ramped-up efforts to push the Baker-Schultz Plan come against a backdrop of intensifying climate action. The popularization of the Green New Deal, the disruptive protests of Extinction Rebellion, mass student walkouts in Europe, the growing threat of climate lawsuits, and expanding movements for divestment from fossil fuels all have contributed to a rising sense of urgency for transformative action to curtail the fossil fuel industry and transition rapidly towards a system of renewable energy.

In pushing the Baker-Schultz Plan, the fossil fuel industry is attempting to line up the political establishment around a more moderate, market-friendly gesture that will sideline more far-reaching demands and minimize disruption in the industry’s primary business of extracting, producing, and burning fossil fuels.

It’s also a way for the fossil fuel industry to assuage rising shareholder and investor demands for climate action, as well as provide cover against legal suits and heavier regulation. As Bloomberg notes: “For businesses, the plan also promises two potent prizes: a shield against climate-related lawsuits tied to past, legal emissions, and the end of federal regulations targeting greenhouse gas releases.”

Americans for Carbon Dividends

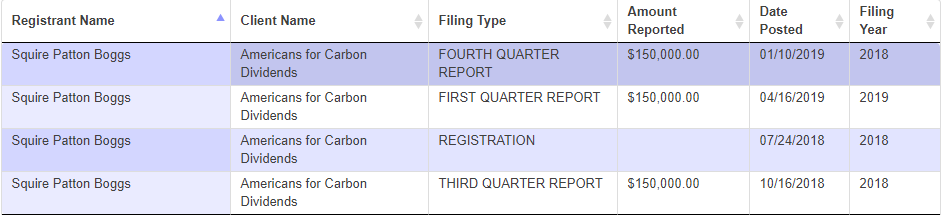

Americans for Carbon Dividends (AFCD) is the U.S. lobbying arm for the Baker-Schultz Plan. AFCD appears to be entirely run by the lobbying firm Squire Patton Bogg and several of its top revolving door lobbyists.

AFCD’s two co-chairs are Squire Patton Boggs lobbyists Trent Lott and John Breaux. Lott is the former Republican Senate Majority Leader, while Breaux is the former Democratic Senate Deputy Majority Whip.

Some of Lott’s and Breaux’s top donors throughout their careers were major fossil fuel and utilities companies like Southern Company, Chevron, Entergy, and ExxonMobil.

Lott, Breaux, and Squire Patton Boggs have been paid a whopping $450,000 since mid-2018 to carry out the Americans for Carbon Dividends lobbying campaign. They, along with several other revolving door lobbyists, including Lott’s former chief of staff, have lobbied the U.S. House, Senate, and the White House.

David Schnittger, a former top aide to John Boehner, has also lobbied for Americans for Carbon Dividends. Boehner, a former speaker of the U.S. House, is also a Squire Patton Boggs lobbyist.

Source: U.S. Senate Lobbying database

As we wrote in February, Joe Crowley, the former ten-term congressman who lost the Democratic primary for New York’s 14th district to Rep. Alexandria Ocasio-Cortez, also recently joined the Squire Patton Boggs.

It’s worth noting that, as Ocasio-Cortez now promotes bold climate ideas like the Green New Deal, Crowley has joined a corporate lobbying firm that has represented powerful fossil fuel industry clients. As Sludge journalist Donald Shaw notes, Crowley’s work with Squire Patton Boggs will align with advancing the interests of Royal Dutch Shell, one of the firm’s clients.

In addition to the fossil fuel industry ramping up its efforts to promote the Baker-Schultz plan, over a dozen major corporations and corporate-aligned environmental groups just announced a new group, the CEO Climate Dialogue, to promote “a market-based solution” to the climate crisis, as Steve Horn from the Real News Network reports.

Members of the CEO Climate Dialogue include major fossil fuel and utilities companies like BP, Shell, Dominion, and PG&E, as well as other corporate powerhouses like Dow and Ford.

The ramped up efforts by the fossil fuel industry and its corporate allies to promote a moderate, business-friendly carbon tax represents an effort to stem the growing tide for much bolder climate action.

As we wrote in February, the fossil fuel industry is the driving force behind an emerging anti-Green New Deal coalition that aims to crush, dilute, or co-opt the rising momentum for a transformative Green New Deal.

While the oil and gas industry spends hundreds of millions on lobbying and campaign donations to protect and expand its fossil fuel operations, it also seeks to sideline rising climate demands by promoting the use of fracked gas and the imposition of a moderate carbon tax as green measures.

A host of corporate-aligned centrist influencers are pushing the fossil fuel industry’s line on natural gas and a carbon tax as part of an attack on the Green New Deal. These include:

- Michael Bloomberg, the world’s 9th richest person, who is a big fracking advocate and who invests his billions in the fossil fuel industry.

- Steven Rattner, a private equity investor who oversees Bloomberg’s wealth, and who has blasted the Green New Deal in the New York Times while promoting the Baker-Schultz Plan.

- Janet Yellen, former U.S. Federal Reserve chair, who along with other top establishment economists is promoting the he Baker-Schultz Plan that a plan “that harnesses markets” and is “much more efficient and less costly than methods proposed by the proponents of the Green New Deal.”

A strong carbon tax will likely be part of any comprehensive response to the global climate crisis; however, what it should look like, and what role it should play in that response, has been a topic of intense debate. As we wrote in March:

While an aggressive carbon tax has a role to play in addressing our climate crisis, many criticize the idea as an insufficient response to the scale of that crisis and question its ability to sufficiently cut emissions fast enough. The Indigenous Environmental Network and Climate Justice Alliance published a 2017 report that called carbon pricing schemes “false solutions to climate change that do NOT keep fossil fuels in the ground” and called them “fraudulent climate mitigation mechanisms that in fact help corporations and governments keep extracting and burning fossil fuels.”

The Baker-Schultz Plan that Rattner supports proposes an initial carbon tax of $40 a ton. The United Nations and its Intergovernmental Panel on Climate Change (IPCC) propose significantly higher levels. Also under the Baker-Schultz Plan, revenue from the carbon tax would be sent back to individuals – a conservative alternative to using the revenue for direct state investment in transitioning away from fossil fuels.

As the climate debate continues to polarize around the demand for urgent, transformative action anchored to the public good versus the appeal for slower, moderate measures anchored to profit-making and the interests of the fossil fuel industry, we can expect further calls by industry-aligned figures to support schemes like the Baker-Schultz Plan.

Read more from Sludge:

Comments ()